The U.S. national debt is a topic that has sparked debates among economists, politicians, and everyday Americans for decades. With the debt surpassing a staggering $35 trillion in 2024, it’s important to understand how we got here, how other countries compare, and why addressing the national debt remains crucial despite global trends of increasing debt.

A Brief History of U.S. National Debt: 1970 – 2024

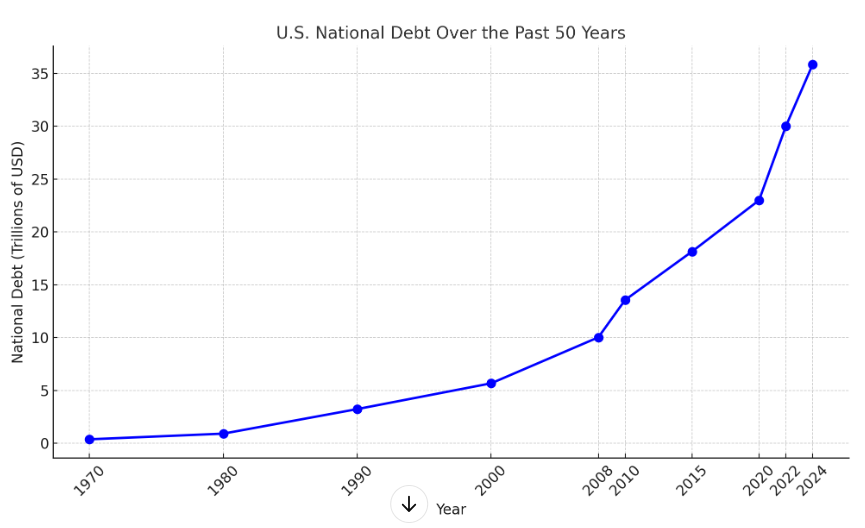

Over the past 50 years, the U.S. national debt has experienced significant growth, influenced by economic cycles, wars, tax policies, and global crises. The following chart illustrates this journey:

Chart: U.S. National Debt Over the Past 50 Years

The chart below shows the trend in U.S. national debt from 1970 to 2024:

Key Historical Milestones:

- 1970s: Starting at around $371 billion in 1970, the national debt remained relatively low. However, economic challenges such as stagflation and increased government spending pushed the debt to $908 billion by 1980.

- 1980s: The Reagan administration saw a sharp rise in national debt, driven by tax cuts, increased defense spending, and an aggressive stance against inflation. By 1990, the debt had ballooned to $3.2 trillion.

- 1990s: The debt continued to grow in the early 1990s due to the Gulf War and economic recession. However, budget surpluses in the late 1990s under President Clinton helped stabilize the debt around $5.7 trillion by 2000.

- 2000s: The 9/11 attacks, wars in Iraq and Afghanistan, and the 2008 financial crisis led to unprecedented government spending. By 2010, the debt had surged to $13.6 trillion.

- 2010s: The aftermath of the financial crisis, combined with economic stimulus measures, saw the debt climb steadily. By 2020, it had reached $23 trillion.

- 2020s: The COVID-19 pandemic required emergency relief spending, pushing the debt over $30 trillion. As of October 2024, the debt stands at $35.85 trillion, fueled by continued federal spending and rising interest rates.

The Global Debt Landscape: A Rising Tide of Borrowing

The United States is not alone in its increasing debt levels. Across the world, countries are grappling with rising national debt, often driven by similar factors:

- Japan: Japan has the highest debt-to-GDP ratio globally, at over 260%. The country has relied heavily on government borrowing to support its aging population and stimulate economic growth.

- European Union: Countries like Italy, Greece, and France have seen debt levels rise due to economic stagnation, social welfare spending, and responses to the 2008 financial crisis. Greece, in particular, faced a severe debt crisis in the 2010s that required international bailouts.

- Emerging Markets: Developing nations, such as Brazil, Argentina, and South Africa, have also increased their debt, often borrowing in foreign currencies to finance infrastructure and development projects. However, these countries face higher risks due to currency fluctuations and lower investor confidence.

Why Most Countries Are Increasing Their Debt:

- Economic Stimulus: Governments worldwide have turned to borrowing as a way to stimulate their economies, especially during crises like the COVID-19 pandemic.

- Social Programs: Rising healthcare and social security costs, especially in aging populations, require increased government spending.

- Geopolitical Conflicts: Wars and military spending, as seen in the U.S. and other countries, contribute to rising national debts.

Why the U.S. is Unique: The Dollar’s Dominance and Investor Confidence

The U.S. has a distinct advantage compared to many other nations when it comes to handling its national debt. Here’s why:

1. The U.S. Dollar as the World’s Reserve Currency

The U.S. dollar is the global reserve currency, meaning it is widely used for international trade and held by central banks around the world. This status gives the U.S. significant borrowing power, as there is strong global demand for U.S. Treasury bonds, considered one of the safest investments.

2. Low Risk of Default

Investors have confidence in the U.S. government’s ability to repay its debt, even as the debt level increases. This is because the U.S. can issue debt in its own currency, and the Federal Reserve can create more money if necessary to meet obligations.

3. Strong and Diversified Economy

The U.S. has the largest and most diversified economy in the world, driven by technology, services, and innovation. This economic strength provides a buffer against the risks associated with high debt levels.

4. Ability to Manage Inflation

Unlike smaller countries, the U.S. has more tools at its disposal to manage inflation, such as adjusting interest rates and using monetary policy to stabilize the economy.

Why Reducing U.S. National Debt Still Matters

Despite the U.S. advantages, there are compelling reasons why reducing national debt should remain a priority:

1. Rising Interest Costs

As interest rates increase, the cost of servicing the national debt becomes a significant burden on the federal budget. In 2024, the U.S. is projected to spend nearly $1 trillion on interest payments alone, diverting funds away from essential services like education, healthcare, and infrastructure.

2. Reduced Fiscal Flexibility

High levels of debt limit the government’s ability to respond to future crises, whether it’s a recession, a natural disaster, or a geopolitical conflict. With so much of the budget tied up in debt payments, there is less room for emergency spending.

3. Burden on Future Generations

Continued borrowing at current levels could result in higher taxes or reduced government services for future generations, potentially stifling economic growth and prosperity.

4. Risk of Inflation and Economic Instability

If investors lose confidence in the U.S. government’s fiscal policy, it could trigger a rapid increase in borrowing costs and inflation. This would harm the economy, as rising prices erode purchasing power and reduce consumer spending.

5. The Moral and Ethical Case

Some argue that running perpetual deficits and passing on the debt burden to future generations is simply irresponsible. A more sustainable fiscal policy would ensure that today’s spending does not come at the expense of tomorrow’s economic stability.

Conclusion: Time to Act on U.S. Debt

While the U.S. has unique advantages that allow it to manage a high level of national debt, this does not mean the issue should be ignored. Rising interest costs, reduced fiscal flexibility, and the burden on future generations all highlight the need for a sustainable approach to fiscal policy.

The U.S. must balance its role as a global economic leader with responsible fiscal management. By addressing the national debt, the country can ensure a stronger and more resilient economy for future generations, setting an example for the rest of the world in an era of rising global debt.

In conclusion, while other nations may follow the trend of increasing debt, the U.S. has the opportunity — and the responsibility — to lead the way in tackling this challenge head-on.

Related Articles: