When the Federal Reserve (often called “the Fed”) lowers interest rates, it can change how much things cost for your family and how the economy works. Here’s what it means in simple terms:

1. How It Affects Your Family:

- Borrowing Money Becomes Cheaper: When interest rates go down, it’s easier for families to borrow money. This means things like home loans (mortgages), car loans, or credit card payments could cost less. For example, if your parents want to buy a house or a car, they might get a loan with a lower interest rate, meaning they pay less money overall.

- Mortgage Payments Might Get Smaller: If your family already has a mortgage, they might be able to get a new one at a lower interest rate. This is called refinancing, and it could mean your parents pay less each month for the house.

- Savings Accounts Earn Less: On the flip side, if your family has savings in the bank, they might earn less money from interest. This means the money they save in the bank grows slower.

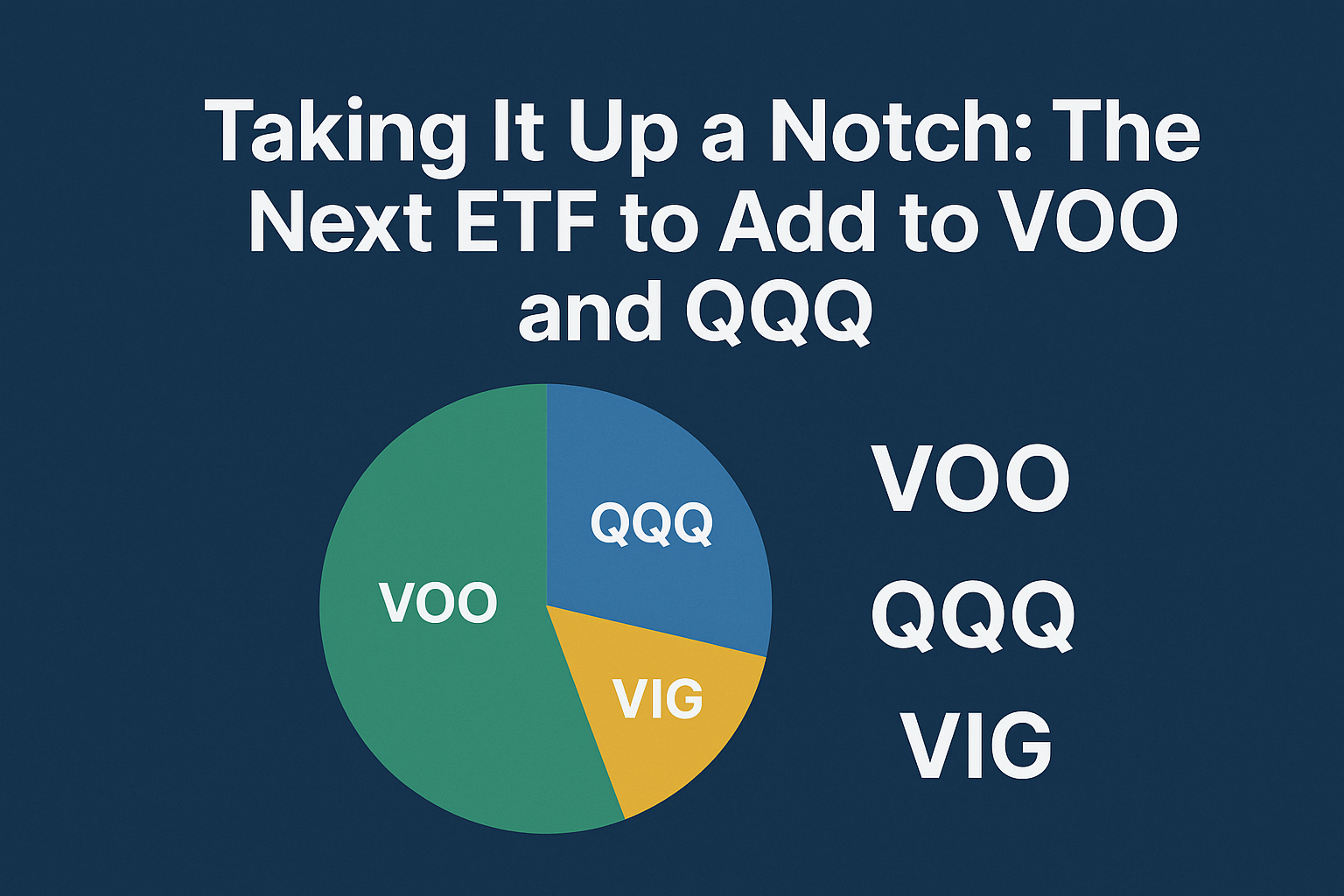

- Investments Could Grow: Sometimes, lower interest rates make the stock market go up. If your family has money invested in stocks or in retirement plans like 401(k)s, they might see their investments grow.

2. How It Affects the Economy:

- Boosting Spending: When the Fed lowers interest rates, people and companies are more likely to spend money. Since it’s cheaper to borrow, more people might buy houses, cars, or even start new businesses. This can help the economy grow faster because more money is being spent.

- Companies Can Grow: Lower interest rates also help businesses borrow money for less, which means they can expand, hire more people, or invest in new projects. This can be good for the job market, meaning your parents or other adults might have better job opportunities or even pay raises.

- Prices Might Go Up: When lots of people are spending more money, there’s a chance that prices could rise. This is called inflation. If inflation goes too high, it can make things more expensive for your family, like groceries or gas.

3. Why the Fed Lowers Interest Rates:

- Help the Economy: The Fed lowers interest rates when they want to help the economy grow. If they think the economy is slowing down, they make borrowing cheaper so people will spend more and businesses will invest more. This is a way to avoid a recession, which is when the economy gets really slow.

- Control Inflation: The Fed also tries to keep inflation at a healthy level (around 2%). If inflation is too low, they might lower interest rates to get it back up so prices don’t start falling. Falling prices can hurt businesses and make it harder for people to find jobs.

What This Means for Your Family:

- If your family is thinking about buying a house or a car, lower interest rates could help them save money on loans.

- If your family has savings in the bank, they might not earn as much interest, but their investments could do better.

- The overall economy might get better, and that could help your family with jobs, wages, or other opportunities.

In short, when the Fed lowers interest rates, it makes borrowing cheaper, which can help families and businesses spend more money and keep the economy moving forward.

Related Articles:

- The Significance of Reaching $100,000 in Investments

- Which is Best for Your 401(k)? Index vs. Target-Date Funds

Financial Disclaimer

The information provided on HelpyYourFinances.com is for general informational purposes only and is not intended to be financial advice. While we strive to ensure the accuracy and reliability of the content, it is important to remember that financial decisions are personal and should be tailored to your individual circumstances.

We strongly recommend that you consult with a qualified financial advisor or other professional before making any financial decisions. The content on this website should not be considered a substitute for professional financial advice, analysis, or recommendations. Any reliance you place on the information provided is strictly at your own risk.