When it comes to international trade, the United States has always played a leading role in shaping the global marketplace. But between sweeping free trade agreements and sudden tariff shake-ups, it can be tough to make sense of where the U.S. stands. Let’s break it down.

What is a Bilateral Trade Agreement?

A bilateral trade agreement is a pact between two countries that outlines specific terms for trade—typically making it easier and cheaper to exchange goods and services. Think of it as a handshake between two governments: “I’ll lower tariffs on your goods if you do the same for mine.”

These agreements often:

- Eliminate or reduce tariffs

- Remove quotas

- Improve market access

- Streamline rules and standards

They benefit consumers (lower prices), exporters (better market access), and governments (stronger ties). However, they can also disrupt domestic industries that suddenly face foreign competition.

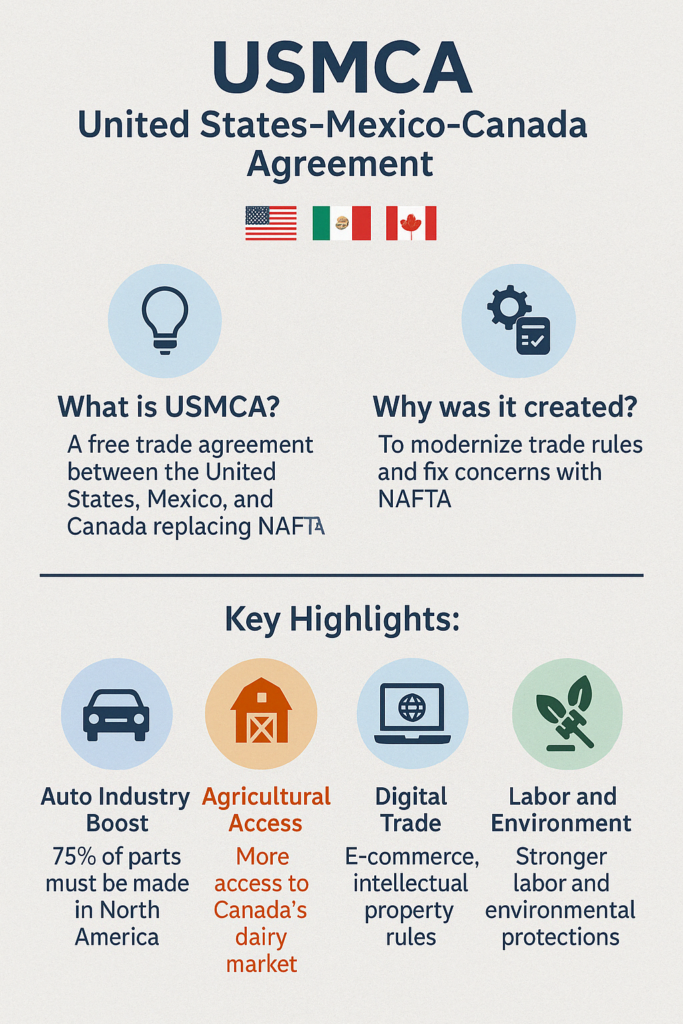

USMCA: A Modern Twist on NAFTA

The United States-Mexico-Canada Agreement (USMCA) replaced NAFTA in July 2020. It’s a trilateral agreement—but worth noting due to its influence and structure.

Key Features of USMCA:

- Auto industry: Requires 75% of car parts to be made in North America; 40-45% by workers earning $16/hr+

- Agriculture: Expands U.S. access to Canada’s dairy and poultry markets

- Digital trade: Adds protections for e-commerce and intellectual property

- Labor & environment: Stronger enforcement mechanisms

- Sunset clause: Reviewed every 6 years, expires in 16 if not renewed

In short: it modernized trade for the digital era and responded to labor and economic concerns left untouched by NAFTA.

Active U.S. Bilateral Trade Agreements

As of now, the U.S. has several active bilateral free trade agreements (FTAs) with the following countries:

- Israel (1985)

- Jordan (2000)

- Australia (2004)

- Singapore (2004)

- Chile (2004)

- Bahrain (2006)

- Oman (2006)

- Peru (2009)

- Colombia (2012)

- South Korea (2012) (KORUS FTA)

- Panama (2012)

These agreements are still active and continue to facilitate trade by lowering barriers, encouraging investment, and supporting mutual economic growth.

Trump-Era Tariffs: Disruption in the Trade Game

While FTAs aim for long-term cooperation, the Trump administration took a different approach—using tariffs as a short-term strategy to rebalance trade relationships.

Key Tariff Actions:

- 2018: Imposed 25% tariffs on steel and 10% on aluminum (Section 232 – national security rationale)

- 2018–2019: Launched a full-blown trade war with China, targeting hundreds of billions in goods (Section 301)

These moves were intended to:

- Protect U.S. manufacturing

- Pressure countries (like China) into better trade behavior

- Renegotiate trade deals perceived as unfavorable

How Did Tariffs Interact with FTAs?

You’d think a free trade agreement would shield a country from tariffs—but Trump’s tariffs used legal workarounds, labeling them national security issues. Even U.S. allies weren’t spared:

- South Korea: Despite the KORUS FTA, faced steel tariffs, but negotiated a quota instead

- Canada & Mexico: Hit with tariffs but negotiated their removal during USMCA talks

- EU & Others: Faced tariffs and retaliated with tariffs of their own on U.S. goods

Timeline: From Bilateral Deals to Trump’s Trade Wars

The visual timeline (see infographic) highlights key milestones:

- 1985–2012: U.S. signs 11 major bilateral FTAs

- 2018: Trump imposes steel & aluminum tariffs

- 2019: Trade war with China escalates

- 2020: USMCA replaces NAFTA, modernizing North American trade

Final Thoughts

U.S. trade policy is a balancing act between opening markets and protecting national interests. Bilateral trade agreements offer stability and cooperation, while tariffs—especially under Trump—were used as negotiation tools to shift leverage.

Understanding these moving pieces helps us make sense of global pricing, business strategy, and even what’s in our shopping carts. Whether you’re an investor, business owner, or just trade-curious, knowing how these policies work puts you ahead of the game.

Related Articles:

- Proposed Tax Bill by Trump – Deduction on auto loan Interest

- How Political Party Control Impacts the Stock Market and Economy

Financial Disclaimer

The information provided on HelpyYourFinances.com is for general informational purposes only and is not intended to be financial advice. While we strive to ensure the accuracy and reliability of the content, it is important to remember that financial decisions are personal and should be tailored to your individual circumstances.

We strongly recommend that you consult with a qualified financial advisor or other professional before making any financial decisions. The content on this website should not be considered a substitute for professional financial advice, analysis, or recommendations. Any reliance you place on the information provided is strictly at your own risk.