What is DCA?

Dollar Cost Averaging (DCA) is a simple way to invest money. Instead of trying to guess the best time to buy, you invest the same amount of money at regular times, no matter what.

How Does DCA Work?

- Fixed Amount: You decide on a set amount of money to invest each time, like $100.

- Regular Intervals: You invest this money regularly, for example, every month.

- Ignore the Price: You buy no matter if the price is high or low. This means you get more when prices are low and less when prices are high.

Example with Simple Numbers

Imagine you decide to invest $100 each month in a stock. Here’s how it could look over six months:

| Month | Stock Price | Amount Invested | Shares Bought |

|---|---|---|---|

| 1 | $10 | $100 | 10 shares |

| 2 | $8 | $100 | 12.5 shares |

| 3 | $12 | $100 | 8.33 shares |

| 4 | $9 | $100 | 11.11 shares |

| 5 | $11 | $100 | 9.09 shares |

| 6 | $10 | $100 | 10 shares |

What Happens Over Time?

- Total Money Invested: $600

- Total Shares Bought: 61.03 shares

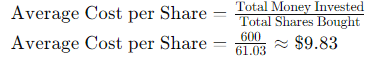

Finding the Average Cost

To find out how much you paid on average for each share:

Why Use DCA?

- Reduces Risk: You don’t have to worry about the right time to invest.

- Easier to Manage: You stick to a simple plan without overthinking.

- Smoothes Out Prices: You avoid paying too much by spreading your investments over time.

Final Thoughts

Dollar Cost Averaging is a great strategy for beginners because it makes investing simple and helps reduce risks. By investing a fixed amount regularly, you can build wealth steadily without worrying about market ups and downs.