Dividend Stocks

- What They Are: These are stocks from companies that regularly distribute a portion of their profits to shareholders in the form of dividends.

- Who Might Like Them: Investors looking for steady income and less volatility.

- Characteristics:

- Regular dividend payments.

- Usually established, stable companies.

- Less price fluctuation compared to growth stocks.

Growth Stocks

- What They Are: These are stocks from companies expected to grow at an above-average rate compared to other companies.

- Who Might Like Them: Investors looking for capital appreciation and willing to take on more risk.

- Characteristics:

- No or low dividend payments (profits are reinvested in the company).

- Higher potential for stock price increase.

- More volatile and risky compared to dividend stocks.

Examples and Hypothetical Returns

Dividend Stocks

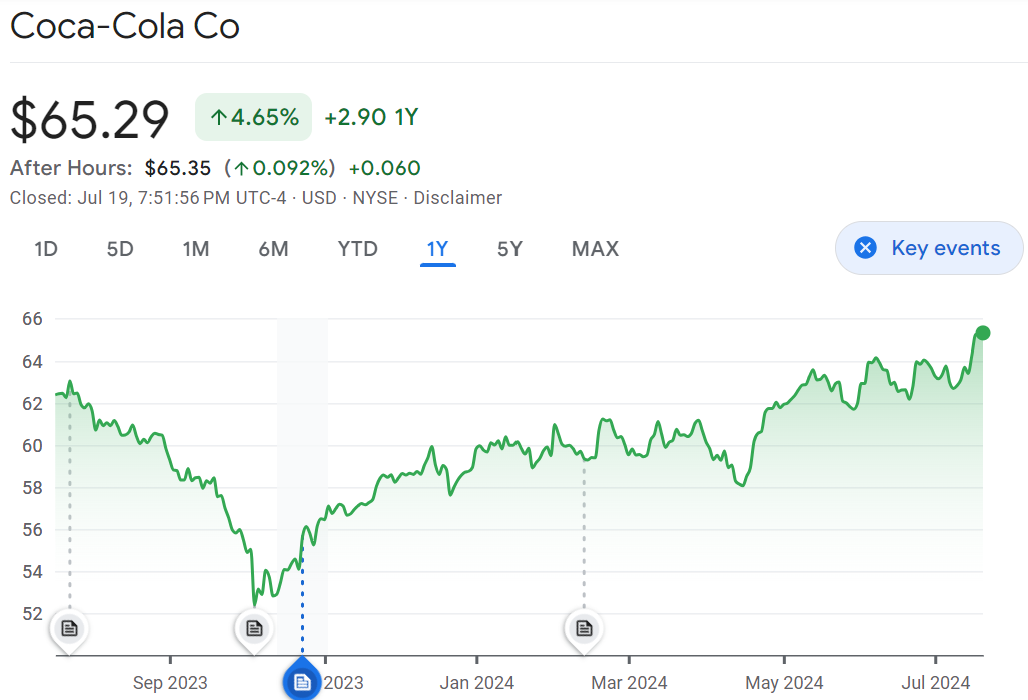

- Coca-Cola (KO):

- Regular dividend payer.

- Well-known, established company.

- Procter & Gamble (PG):

- Consistent dividend payments.

- Stable, consumer goods giant.

- Johnson & Johnson (JNJ):

- Reliable dividends.

- Large, diversified healthcare company.

Growth Stocks

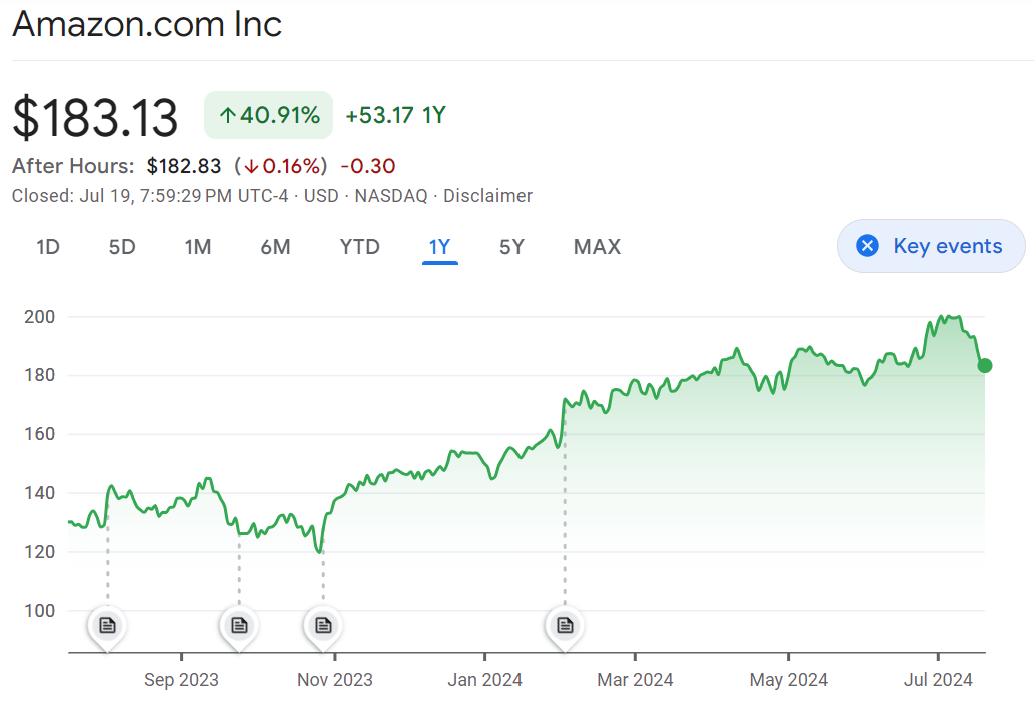

- Amazon (AMZN):

- High growth potential.

- Reinvests profits into expansion and innovation.

- Tesla (TSLA):

- Rapid growth in the electric vehicle market.

- No dividends, profits reinvested.

- Nvidia (NVDA):

- Leading growth in the semiconductor industry.

- Focus on reinvestment over dividends.

Hypothetical Investment Returns

Let’s assume you invested $1,000 in each of these stocks a year ago. Here’s how they might have performed based on historical data (note: actual returns can vary):

Dividend Stocks

- Coca-Cola (KO):

- Stock Price (July 2023): $62.39

- Stock Price (July 2024): $65.29

- Dividend Yield: ~3.0%

- Total Return: 4.6% (price increase) + 3.0% (dividends) = 7.6%

- Investment Value: $1,076

- Procter & Gamble (PG):

- Stock Price (July 2023): $150.56

- Stock Price (July 2024): $167.96

- Dividend Yield: ~2.5%

- Total Return: 11.56% (price increase) + 2.5% (dividends) = 14.06%

- Investment Value: $1,156

- Johnson & Johnson (JNJ):

- Stock Price (July 2023): $168.38

- Stock Price (July 2024): $154.69

- Dividend Yield: ~2.8%

- Total Return: -8.1% (price decrease) + 2.8% (dividends) = -5.4%

- Investment Value: $946

|  |  |

Growth Stocks

- Amazon (AMZN):

- Stock Price (July 2023): $130.00

- Stock Price (July 2024): $183.13

- Total Return: 40.91% (price increase)

- Investment Value: $1,409

- Tesla (TSLA):

- Stock Price (July 2023): $262.90

- Stock Price (July 2024): $239.20

- Total Return: 9.0% (price decrease)

- Investment Value: $910

- Nvidia (NVDA):

- Stock Price (July 2023): $45.52

- Stock Price (July 2024): $117.93

- Total Return: 159.07% (price increase)

- Investment Value: $1,591

|  |  |

These are simplified examples and actual returns can vary based on many factors. Dividend stocks provide more stability and regular income, while growth stocks offer higher potential returns but come with more risk.