As a writer for this website, HelpYourFinances.com, I’ve realized that some of you may not fully understand what a stock is or what it means to own one. Stocks are one of the most common ways people grow their wealth, yet they can feel intimidating if you’re new to investing. So, in this article, I’ll break down the basics of what owning a stock means, why it’s important, and how it can help you build wealth over time.

What is Equity Ownership?

When you buy a stock, you are purchasing a tiny piece of a company. This tiny piece is called equity ownership. It means you now own part of that company, even if it’s a very small share.

For example:

- Imagine a company as a pie.

- The pie is divided into lots of small pieces (shares).

- When you buy a share, you own one piece of the pie.

As a part-owner, you share in the company’s successes (or losses). This is why it’s important to choose your stocks wisely!

Why is Equity Ownership Important?

- Your Money Works for You: Instead of just keeping your money in a savings account where it grows slowly (if at all), owning stocks gives you the chance to grow your money faster as the company grows.

- Ownership in Big Companies: Even if you can’t start a big company like Apple or Amazon, buying their stock lets you own a small piece of their success.

- Access to Dividends: Many companies share their profits with stockholders by paying dividends. This is like getting a thank-you check for being an investor.

- Wealth Creation Over Time: Historically, the stock market has grown in value over the long term. By investing in stocks, you can potentially build wealth as the companies you invest in grow.

How Does Equity Ownership Generate Wealth?

There are two main ways stocks help you build wealth:

- Stock Price Increases (Capital Gains):

- When the company does well, its value often increases.

- This makes the stock price go up, and you can sell your shares for more than you paid.

Example: You buy a stock for $50, and later, it’s worth $100. If you sell, you made $50 in profit.

- Dividends:

- Some companies share their profits with you by giving you regular payments (dividends).

Example: You own 100 shares of a company, and they pay $2 per share annually. That’s $200 in passive income.

- Some companies share their profits with you by giving you regular payments (dividends).

Why Invest in Stocks at All?

Imagine planting a tree:

- A savings account is like a tree that grows very slowly.

- Stocks are like trees that grow faster, but they need care (choosing good companies) and patience (holding onto your investment long enough to see results).

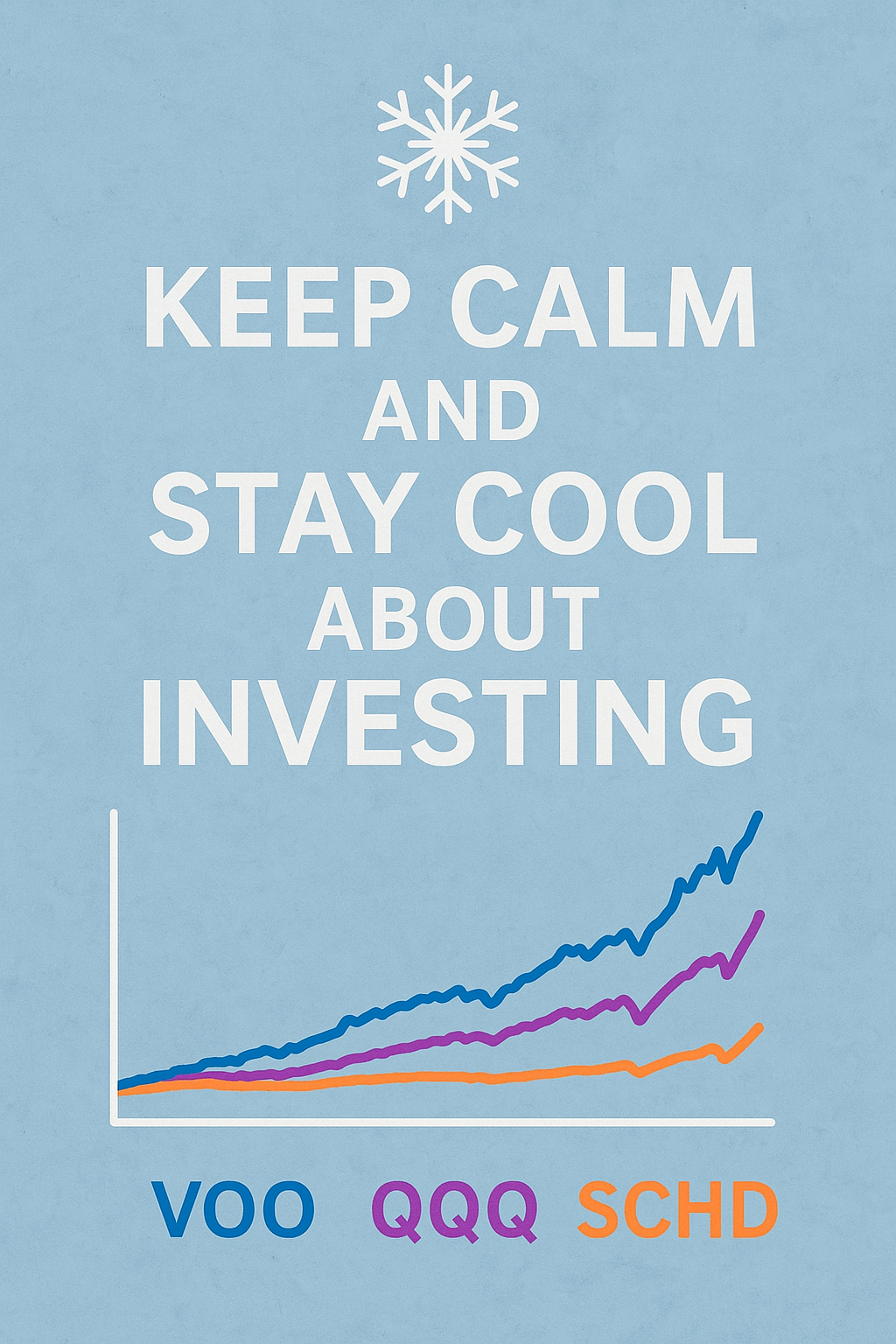

Over time, investing in stocks has proven to grow wealth faster than most other types of investments, especially if you reinvest your profits.

Key Takeaway

Owning equity is like becoming a co-owner in a business. It allows your money to grow as the business grows, letting you build wealth and even earn passive income through dividends. The key is to invest wisely and think long-term.

If you’re just getting started with investing, don’t be afraid to take the first step. Even small amounts invested over time can make a big difference in your financial future!

Related Articles:

Financial Disclaimer

The information provided on HelpyYourFinances.com is for general informational purposes only and is not intended to be financial advice. While we strive to ensure the accuracy and reliability of the content, it is important to remember that financial decisions are personal and should be tailored to your individual circumstances.

We strongly recommend that you consult with a qualified financial advisor or other professional before making any financial decisions. The content on this website should not be considered a substitute for professional financial advice, analysis, or recommendations. Any reliance you place on the information provided is strictly at your own risk.