If you’ve been working for a while and still feel like your money is slipping through your fingers, you’re not alone. Many people hustle day in and day out, only to find themselves constantly wondering, “Where did all my money go?” One of the biggest mindset shifts that can help is understanding the balance between control and automation in personal finance. Get this right, and you’ll not only feel more confident—you’ll start to see real results.

The Control Mindset: Manual with Purpose

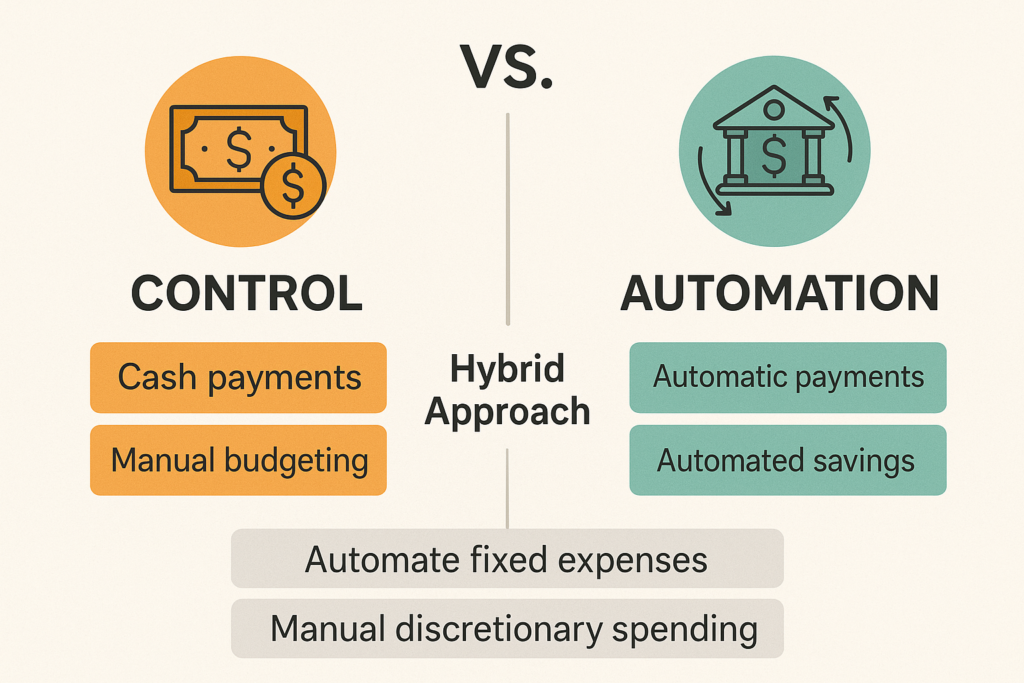

People who love control often prefer to handle everything manually—paying bills with cash or entering every transaction into a spreadsheet. This group feels more grounded when they can see and touch every dollar.

Benefits of Control:

- Awareness: You know exactly where your money is going.

- Discipline: Physically seeing money leave your hands helps curb overspending.

- Accountability: It’s hard to ignore bad habits when you’re tracking them manually.

But let’s be honest—this method can get exhausting. It’s like driving a stick shift in L.A. traffic. Yes, you’re in control, but you’re also doing a lot more work than necessary.

The Automation Mindset: Set It and Semi-Forget It

On the flip side, the automation camp lets technology take the wheel. Bills are paid automatically, savings transfer on payday, and retirement accounts hum along without touching a button.

Benefits of Automation:

- Consistency: Bills get paid on time—no late fees, no damage to your credit.

- Mental Freedom: Fewer decisions to make means less stress.

- Savings on Autopilot: You build wealth quietly over time.

But automation can make your finances feel invisible, and that’s where the danger lies. You might not realize your Netflix, gym, and six other subscriptions are bleeding you dry.

The Hybrid Approach: Best of Both Worlds

The magic happens when you combine both strategies:

- Automate Fixed Expenses: Rent, mortgage, car payments, insurance. These are non-negotiable, so take the stress off your plate.

- Manually Manage Discretionary Spending: Groceries, dining out, shopping. Use a debit card or even cash envelopes for these. Feel the spending to stay in control.

- Set Minimum Credit Card Auto-Payments: This protects your credit score from missed payments.

- Pay Full Credit Card Balances Manually: Stay conscious of your total spending and avoid interest charges.

Budgeting: Which Method Works for You?

- Control-Focused Options: Zero-based budgeting, envelope method.

- Automation-Friendly Options: 50/30/20 rule, pay-yourself-first approach.

Try combining them. Use a fixed-percentage rule, but track your fun money manually.

Emergency Funds: Manual or Auto?

The best method? Automatic savings transfers, scheduled right after payday. It removes the temptation to spend first and save later. Just set it and adjust as your income grows.

Investing: Autopilot Wins with Check-Ins

You don’t need to be Warren Buffett. Auto-contribute to your 401(k) or Roth IRA. Then do a monthly check-in to rebalance or adjust. Don’t pick individual stocks unless you’re truly passionate and educated.

Beating Lifestyle Creep

When you automate too much, you might forget about expenses quietly piling up—old subscriptions, auto-renewals, etc. Do a quarterly audit: “Am I still using this? Is it worth it?”

Money Routines: Keep It Real

Create a monthly money date with yourself (or your partner). Check:

- Budget vs. actual spending

- Progress toward savings goals

- Upcoming expenses

Even 30 minutes a month can change your trajectory.

Final Thoughts: Your Money, Your System

There’s no one-size-fits-all solution. Some people need the structure of full control. Others thrive on automation. Most of us? We’re somewhere in between.

So if you’ve felt like your paycheck disappears before you can use it wisely, maybe it’s time to look at your systems. Build a structure that works for you—one that balances control and convenience. That’s where true financial confidence begins.

And remember: The goal isn’t to obsess over every penny. It’s to tell your money where to go so it doesn’t run off without telling you.