Who Are the Millennials?

Millennials, also known as Generation Y, are individuals born roughly between 1981 and 1996. As of today, they are in their late 20s to early 40s, representing the largest generational cohort in the U.S. workforce. This generation grew up during a period of rapid technological change, but also faced significant economic challenges as they entered adulthood.

Economic Context: The Great Recession and Its Impact

For many millennials, graduating from college coincided with the 2008 financial crisis, a period marked by a severe economic downturn, job losses, and market instability. This created a challenging start for their careers, as job opportunities were limited, and wages were often stagnant. Many millennials also took on substantial student loan debt, adding financial stress as they struggled to build a solid foundation during one of the worst economic periods in modern history.

Top 5 Financial Challenges Faced by Millennials

- Student Loan Debt

- Millennials hold the highest student loan debt burden of any generation, with many owing tens of thousands of dollars upon graduation. According to Federal Reserve data, the average millennial graduate carries about $30,000 in student loans. This debt can delay key life milestones like buying a home or starting a family.

- High Cost of Living and Housing Affordability

- The cost of living has increased significantly, particularly in urban areas where millennials often work. Housing prices have skyrocketed, making homeownership a distant dream for many. Rent has also risen sharply, consuming a large portion of monthly incomes.

- Stagnant Wages

- Despite being the most educated generation, millennials have faced wage stagnation. Adjusted for inflation, their earnings have not kept pace with rising costs, making it harder to save and invest for the future.

- Economic Instability

- In addition to the 2008 crisis, millennials have weathered several economic shocks, including the COVID-19 pandemic. The pandemic led to mass layoffs and increased uncertainty, especially in service and retail industries where many millennials are employed.

- Inflation and Financial Uncertainty

- Inflation has become a major issue in recent years, significantly impacting millennials’ purchasing power. The rising costs of essentials like food, healthcare, and housing have put additional pressure on their already stretched budgets.

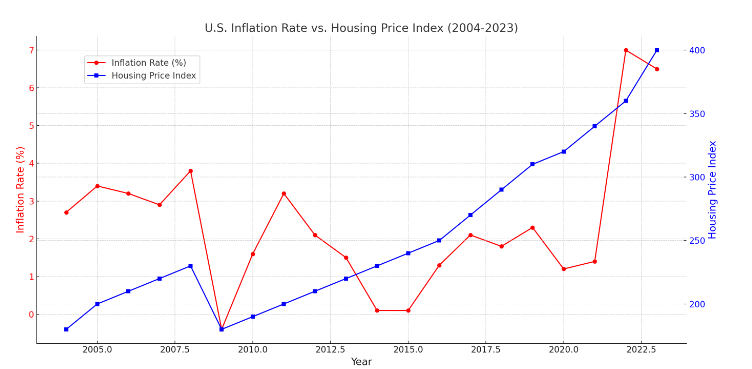

Inflation vs. Housing Prices (2004-2023)

To understand the financial pressures faced by millennials, let’s look at a comparison of the U.S. inflation rate and the housing price index over the past two decades.

The following chart highlights the trends in inflation and housing prices from 2004 to 2023:

- Inflation Trends: Inflation remained relatively low until 2020 but surged dramatically during 2021-2022, reaching a peak of 7%, the highest level in 40 years. This sharp rise in inflation affected the cost of goods, rent, and everyday expenses, squeezing millennials’ budgets.

- Housing Prices: The housing market saw a steady increase from 2004, but prices dipped during the 2008 financial crisis. However, since then, housing prices have rebounded and climbed steadily, reaching unprecedented levels in recent years. The high demand, coupled with low supply and inflation, has made homeownership even more challenging for millennials.

The chart clearly shows the divergence between inflation and housing prices, illustrating how housing costs have outpaced general inflation, creating a barrier to entry for millennial homebuyers.

The Silver Lining: Opportunities in the Gig Economy and Social Media

Despite the financial challenges, millennials are also uniquely positioned in an era of unprecedented opportunities. The rise of the gig economy and social media has opened new avenues for income generation that previous generations did not have.

1. The Gig Economy

The gig economy has expanded rapidly, offering flexible work options through platforms like Uber, DoorDash, Upwork, and Fiverr. These platforms allow millennials to supplement their income with side gigs, whether it’s driving for a ride-share service, freelancing in creative fields, or providing specialized services online.

- Supplemental Income: For many, gig work serves as a crucial source of additional income that helps cover living expenses or pay off debt.

- Low Barriers to Entry: Most gig jobs require minimal qualifications, allowing workers to start earning quickly.

2. Social Media and Content Creation

The rise of YouTube, TikTok, Instagram, and other platforms has enabled a new class of digital entrepreneurs. Millennials are harnessing social media to build personal brands, start businesses, and create multiple income streams.

- Monetization Opportunities: Successful creators can earn through ad revenue, sponsorships, affiliate marketing, and digital products.

- Scalability: Unlike traditional jobs, income from social media can scale rapidly if content goes viral or attracts a loyal following.

Combining Traditional Employment with Side Hustles

For many millennials, a sustainable financial strategy involves combining a full-time job with side hustles or freelance work. This approach offers the stability of traditional employment while providing the flexibility and earning potential of the gig economy. By diversifying income streams, millennials can better navigate economic uncertainty and work towards achieving their financial goals.

The Path Forward

While the financial landscape for millennials is challenging, the unique times we live in offer opportunities for creativity and resilience. By leveraging new income channels and embracing a flexible mindset, millennials can find ways to overcome these obstacles and build a secure financial future.

In summary, while millennials face significant financial pressures due to student loans, housing affordability, wage stagnation, and inflation, the rise of the gig economy and digital platforms provides new avenues for income. The combination of a stable full-time job and supplemental gig work could be the key for millennials to thrive in today’s dynamic economy.

Related Articles:

Financial Disclaimer

The information provided on HelpyYourFinances.com is for general informational purposes only and is not intended to be financial advice. While we strive to ensure the accuracy and reliability of the content, it is important to remember that financial decisions are personal and should be tailored to your individual circumstances.

We strongly recommend that you consult with a qualified financial advisor or other professional before making any financial decisions. The content on this website should not be considered a substitute for professional financial advice, analysis, or recommendations. Any reliance you place on the information provided is strictly at your own risk.