Have you ever wondered how much you need to save every week, every two weeks, or every month in order to afford something of high value?

I’ve developed an Excel spreadsheet that can assist you in forecasting and modeling your savings. With just seven simple inputs, you’ll be able to visualize your bank balance on a daily basis and determine if you can afford your significant purchase or expense.

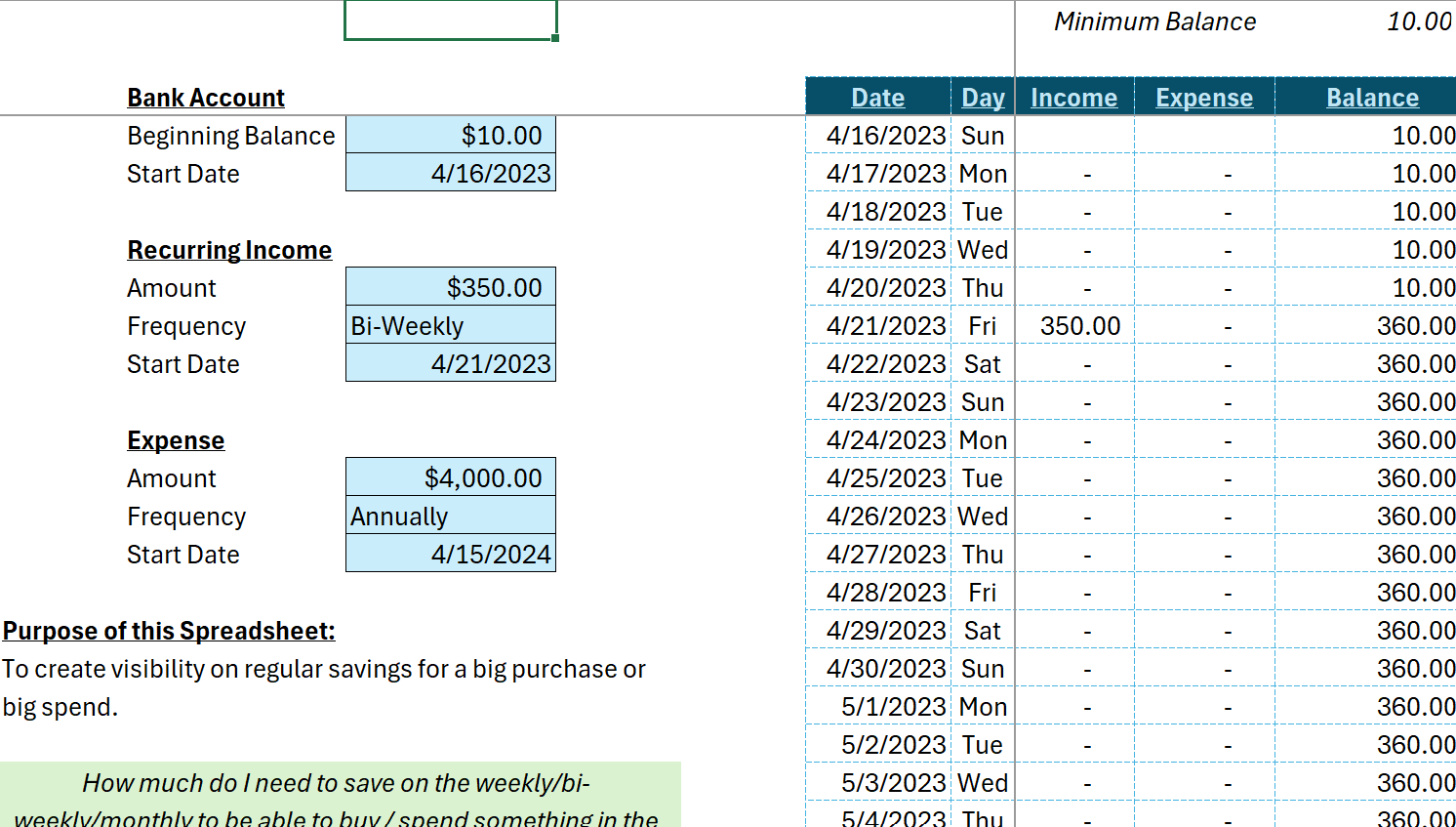

Here are the seven inputs required (all highlighted in blue cells):

- Beginning Balance: The amount in your bank account at the start of the model. You can either set up a new account or use your existing one.

- Start Date (Bank Account): This date serves as the starting point for the model.

- Recurring Income Amount: The amount you’re willing to save on a regular basis.

- Recurring Frequency: How often you will deposit money into the account.

- Expense Amount: The amount of your significant spending or expense that you’re saving for.

- Expense Frequency: How often you’ll need to make payments.

- Expense Start Date: The date of the first payment.

I trust that this file will prove useful to you. If you require a more advanced forecasting or modeling tool, please don’t hesitate to reach out to us.

Here’s the link to access the file: CashForecast-Basic

HelpYourFinances specializes in creating sophisticated Financial Forecasting and Cash Forecasting tools using Microsoft Excel. Feel free to contact us for assistance.