In today’s world, convenience is king. Services like Uber Eats, Amazon Prime, and TaskRabbit promise to save us time and effort, delivering goods and services straight to our door. But while the allure of convenience is undeniable, the hidden costs can add up quickly. This is especially true when we look at everyday purchases like coffee, where delivery fees and markups can easily double or triple the price.

Consider This Scenario: Two Individuals, Two Different Financial Realities

Let’s set the stage with two people who face this decision in different ways:

- Anna, a high-earning consultant, bills clients at $80 per hour. Her work is time-sensitive and often billed by the hour, meaning that every minute she saves can be directly converted into earnings. She frequently finds herself swamped with meetings and projects, making it tempting to use services like Uber Eats for quick coffee deliveries to maximize her productivity.

- Brian, on the other hand, earns $20 per hour in a more traditional office job. His time isn’t directly tied to billable hours, and his income remains consistent regardless of how he manages his breaks. While he values his lunch hour as a time to unwind, he also considers using Uber Eats when he’s feeling pressed for time or simply wants a little extra comfort.

Both Anna and Brian are faced with a choice: spend 20-30 minutes stepping out to get a cup of coffee for $5, or opt for the convenience of delivery, where the total cost might rise to $15 after markups and fees.

But Is It Justifiable?

The answer depends on the hidden factors behind that decision, such as the time value of money, opportunity costs, and the potential for lifestyle inflation. It’s easy to assume that convenience is always worth the price, especially for high earners like Anna. However, this assumption often overlooks the broader financial implications that come with habitually choosing convenience.

1. The Time Value of Money

To understand whether it’s financially optimal to use a service like Uber Eats, we need to first consider the time value of money. In simple terms, the time value of money is the idea that time is a resource that can be converted into earnings.

- For Anna, spending 30 minutes getting coffee means losing out on potential billable work worth $40 (half of her $80 hourly rate). Therefore, paying an extra $10 for delivery could make sense if it allows her to continue working and earn more during that time.

- For Brian, the story is different. His time is worth $20 per hour, so the 30 minutes spent getting coffee “costs” him only $10 in potential lost productivity. If he uses Uber Eats and pays $15 instead of $5, he’s effectively losing money, as the time saved isn’t as valuable.

But Opportunity Cost Matters Too

The opportunity cost of each decision is what Anna or Brian could have done instead of taking the time to go get coffee. For Anna, that opportunity cost is high because her time is directly tied to her earnings. For Brian, the opportunity cost is lower, especially if he would use the time saved for non-productive activities, like browsing social media. Therefore, it’s easier for Anna to justify the extra expense since she can use the saved time for productive, revenue-generating work.

2. Convenience vs. Habit: The Risk of Lifestyle Inflation

Convenience can quickly transform from an occasional treat into a regular habit. This is where the hidden cost of convenience services becomes more apparent.

- For Anna, regular use of Uber Eats might seem negligible in the short term. However, even small, frequent indulgences can lead to lifestyle inflation, where her spending habits rise alongside her income. While she might not feel the financial impact now, this pattern can reduce her long-term savings and investment potential.

- For Brian, the impact is even more immediate. At $20 per hour, paying $15 for a coffee via delivery might represent almost an entire hour’s wage. If he falls into the habit of choosing convenience regularly, it could significantly affect his monthly budget and savings, making it much harder for him to achieve financial stability.

But Isn’t Convenience Worth It for Quality of Life?

This is where the decision becomes a matter of personal values. Both Anna and Brian might choose convenience occasionally as a way to enhance their quality of life, treating it as a small luxury. However, when convenience becomes the default choice rather than a thoughtful one, it can lead to financial strain and lost opportunities for saving or investing.

3. The Hidden Costs of Outsourcing Everyday Tasks

There’s a broader lesson here about the trade-offs between outsourcing tasks for convenience and handling them ourselves. In business, the idea of outsourcing non-core tasks is popular because it’s seen as a way to free up time for more valuable work. But in personal finance, the calculation isn’t always as clear-cut.

When Does It Make Financial Sense to Outsource?

The key is to consider the true cost of outsourcing, which includes more than just the direct expense:

- Direct Costs: The fees and markups associated with services like Uber Eats.

- Hidden Costs: Potential impacts on long-term savings, lost opportunities for developing frugality, and the risk of lifestyle inflation.

- Opportunity Costs: What could you be doing with the time saved, and does it generate more value than the cost of convenience?

In many cases, the financial optimization of outsourcing depends on whether the saved time is used productively. If Anna uses the extra time for billable work, she might justify the expense. But if she’s just using the time for leisure without regard to her financial goals, the cost of convenience can add up over time.

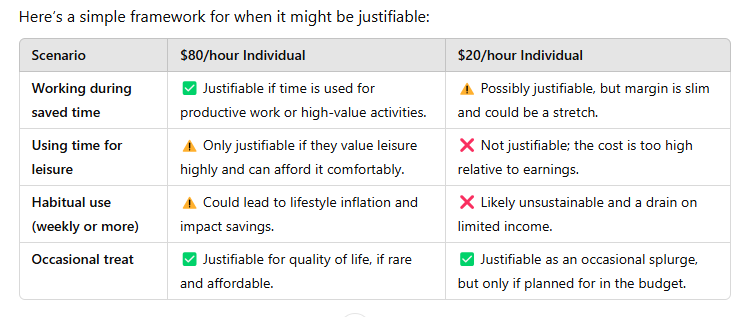

Therefore, Is Convenience Always Worth It?

Not necessarily. For Anna, the answer depends on her ability to consistently use the saved time to generate more value than the cost of delivery. For Brian, the financial trade-offs are harder to justify unless it’s a rare treat or he’s under significant time constraints. In both cases, the decision should be made intentionally, weighing the immediate benefit of convenience against the long-term impact on their financial goals.

Conclusion: Convenience Is a Double-Edged Sword

The convenience of services like Uber Eats can be appealing, but it comes with hidden costs that aren’t always apparent. For high earners like Anna, paying for convenience might be justifiable if it allows them to maximize their earnings or improve their quality of life. But even for her, there’s a risk of lifestyle inflation that can erode long-term financial success.

For lower earners like Brian, the cost of convenience is often too high relative to their earnings, making it a luxury that could harm their financial health if used habitually.

Ultimately, the key is to make intentional choices about when to pay for convenience and when to invest the time instead. By considering both the immediate benefits and the long-term trade-offs, individuals can find a balance that aligns with their financial priorities and values.

Related Articles: