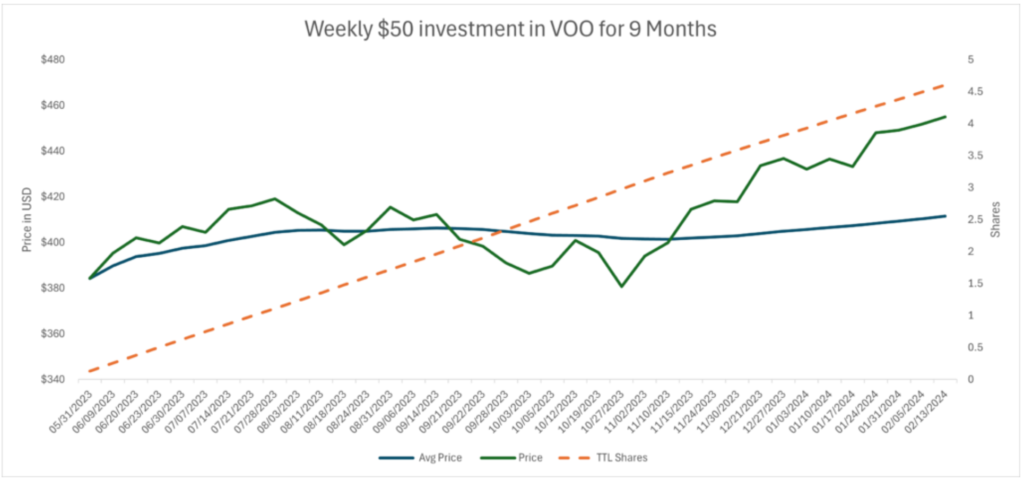

I’ve been investing $50 each week in VOO – Vanguard S&P 500 ETF, starting in May 2023. Below is the summary at the end of 9 months.

4.6 total shares acquired

$411.45 Average share price

$1,892.68 Total Invested

$2,118.12 – Market Value @ end of day 2/13/2024

$225.44 – Unrealized Gain

11.91% – Return on capital

$50 in VOO is much better than $50 spent in Coffee Latte each week.

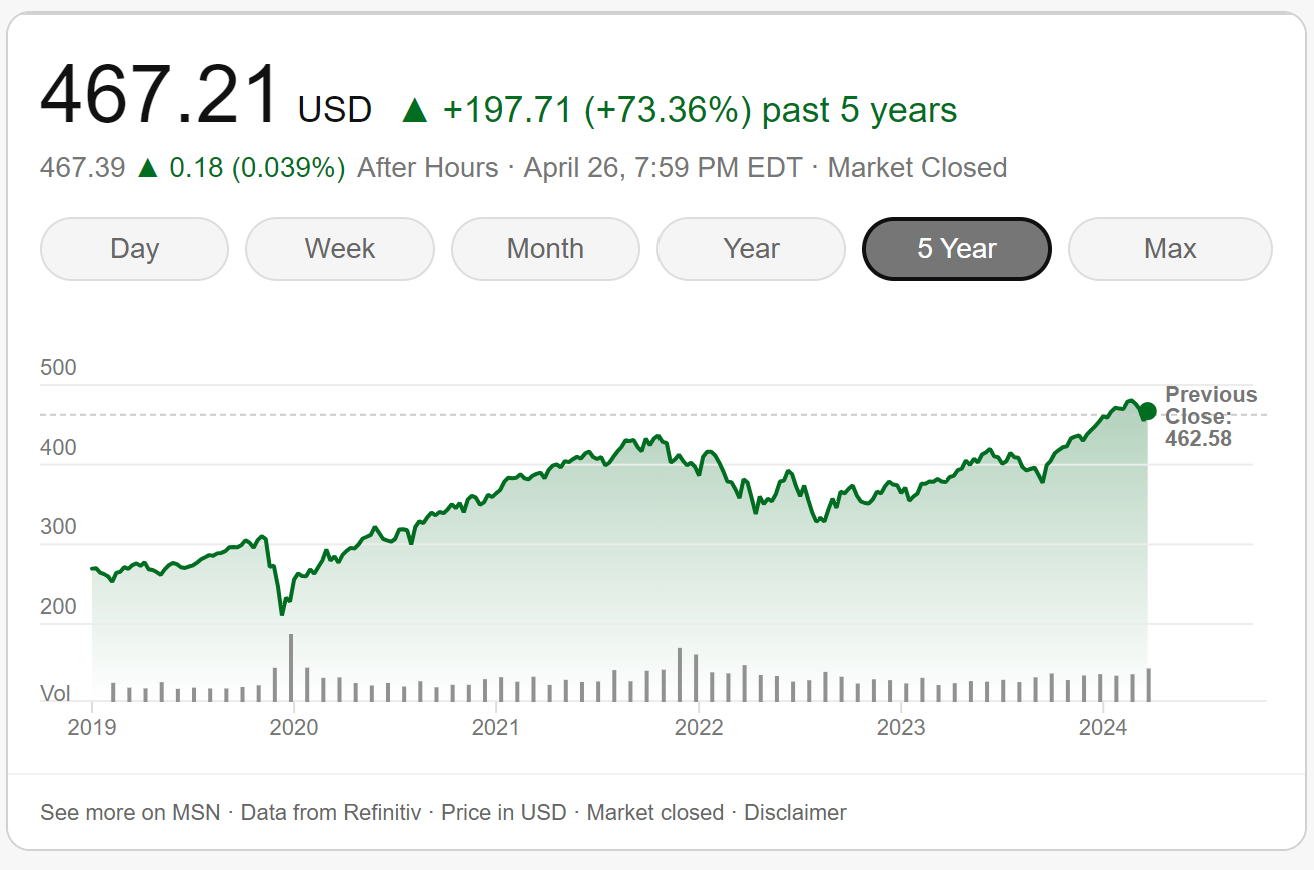

VOO is an ETF (investment vehicle) that lets you own a tiny piece of many big companies. It’s like buying a variety pack of your favorite snacks instead of just one kind. With VOO, you can spread your money across lots of different businesses without having to pick them individually. Since inception (Sept 2010), the price has gone up +370% and it has one of the lowest expense ratio of 0.03%.

VOO Product summary

- Invests in stocks in the S&P 500 Index, representing 500 of the largest U.S. companies.

- Goal is to closely track the index’s return, which is considered a gauge of overall U.S. stock returns.

- Offers high potential for investment growth; share value rises and falls more sharply than that of funds holding bonds.

- More appropriate for long-term goals where your money’s growth is essential.