Below are some of the strategies discussed in the video on how to minimize or avoid income taxes from your investment.

- Move to Puerto Rico – There’s no income tax in Puerto Rico. Puerto Rico is part of the United States. The process is very similar when you change residents within US states. The only caveat is to make sure you live there at least 6 months + 1 day, in case IRS is doing an audit on your tax.

- Invest / Trade within your retirement account : ROTH IRA would be the vehicle to use, as any gain from the investment will be tax free. Unlike Traditional 401K or IRA, the money you distribute after 59.5 years old from ROTH IRA will not be subject to Income Tax.

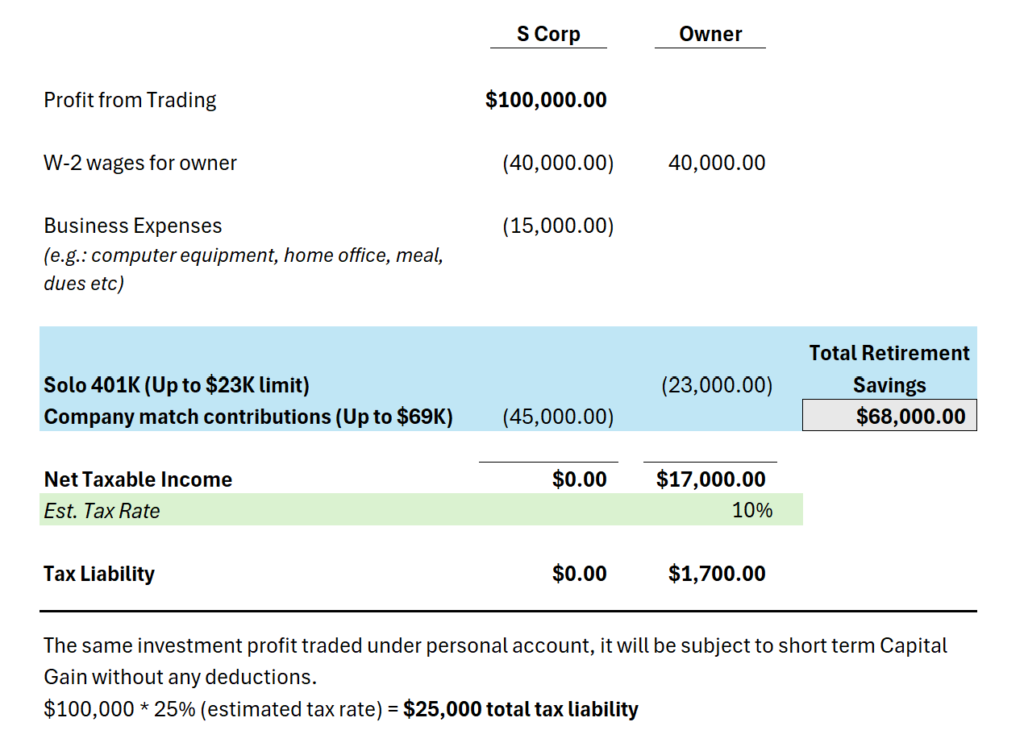

- Trading in business account : S Corp – Business account allows you to make business deductions to your profit or income from investment. Consider the following:

This video was uploaded on April 15, 2024. Please check with your tax advisor before making any changes to your tax situation. Please note this website is not affiliated with the content creator.

Related Articles:

- Offsetting Capital Gains with Losses Can Reduce Taxes

- Why SCHD is Splitting 3-for-1 and What It Means for Investors

Disclaimer: This article is for informational purposes only and should not be considered as tax advice. Tax laws and regulations are complex and subject to change. Readers are advised to consult with a qualified tax advisor or financial professional to discuss their specific situation and ensure compliance with current tax laws.