If you’ve been following my 9-month and 12-month investing journey in VOO, you might be wondering how I managed it. VOO is currently trading at over $400 per share, so to invest $50 a month, I’ve been buying partial shares. It’s kind of like ordering a small pizza slice instead of the whole pie—equally delicious but easier on the wallet.

Here’s how I did it:

- Open a Brokerage Account: You need a brokerage account to buy partial shares. I opened an Investing and Trading account with Fidelity.com. Why Fidelity, you ask? Well:

- Partial Shares: They let you buy partial shares, unlike some brokers that only deal in full shares.

- Automatic Transfers: You can schedule automatic transfers, making regular investments a breeze. It’s like setting your coffee machine to brew automatically every morning—effortless and essential.

- Direct Deposit Setup: Fidelity provides account and ABA numbers, so you can set up direct deposits into your account. It’s as easy as setting up direct deposit for your paycheck, and way more fun than watching your money go straight to bills.

- Set Up Direct Deposit: I set up a direct deposit from my bi-weekly paycheck to go directly into my Fidelity account. As discussed in the Mastering the Art of Saving, automating the process is key to successful saving. Think of it as having a robot butler who takes care of your investments while you focus on more important things—like binge-watching your favorite series.

- Buy VOO: If you get paid on Friday, the money will be deposited in the Fidelity account by Friday morning. It’s immediately available for trading. So, I either go to Google Finance or the Fidelity app to see how VOO is doing. If it’s RED, then I’ll buy. If it’s GREEN, I’ll hold and come back later or the next day. Remember, you want to buy low. It’s like shopping for deals—no one brags about buying stuff at full price.

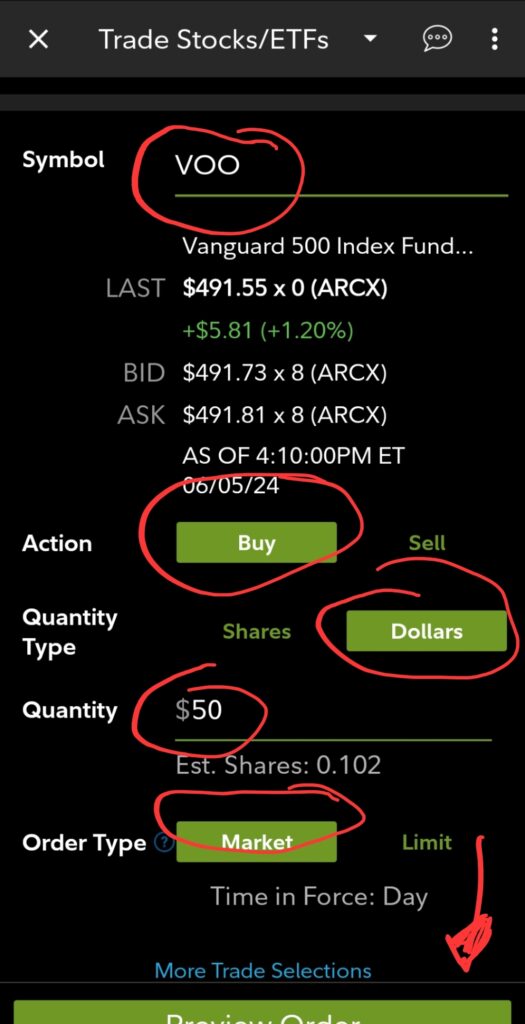

Easy Steps to Buy VOO in Fidelity:

- Click on the TRADE button.

- Enter VOO as the symbol.

- Set the action to BUY.

- Select Quantity Type as Dollars and enter the dollar amount you want to invest.

- Choose Order Type = Market and submit your order.

Here’s a screenshot from the Fidelity app for a visual guide (unfortunately, no screenshots of my celebratory dance after making a good trade).

After the Purchase

After purchasing the ETF, just let it grow. Whether you’re investing $10, $50, $100, or any amount, what matters is that you start. I’ve even opened accounts for each of my teenagers so they can begin their investing journeys earlier than I did. Trust me, your future self will thank you—and so will your kids when they realize you’ve given them a head start.

So, to sum up, investing in VOO with just $50 a month is not only possible, it’s also a smart move for your future. Plus, it’s a lot more exciting than just leaving your money in a savings account. Happy investing!

The information provided on this website is for informational purposes only and should not be considered as investment advice, financial advice, or an offer to buy or sell any securities. All investments involve risk, including the potential loss of principal. There is no guarantee that the investment strategies or the views expressed will result in profits or that they will not result in losses.

Past performance is not indicative of future results. Before making any investment decision, you should seek the advice of a qualified financial advisor and conduct your own research and due diligence. We do not provide personalized investment advice and do not take into account the individual financial circumstances, investment objectives, or risk tolerance of any investor.

The information contained herein has been obtained from sources believed to be reliable, but its accuracy and completeness are not guaranteed. We assume no liability for any loss or damage resulting from reliance on this information.

By accessing this website, you agree to be bound by the terms and conditions set forth in this disclaimer.