Previously, in my journey of Investing in VOO, I shared a 9-month update on my quest to invest $50 each week into the Vanguard S&P 500 ETF. At that point, I was thrilled to report an 11.91% return on my investment, which translated to a $225.44 unrealized gain.

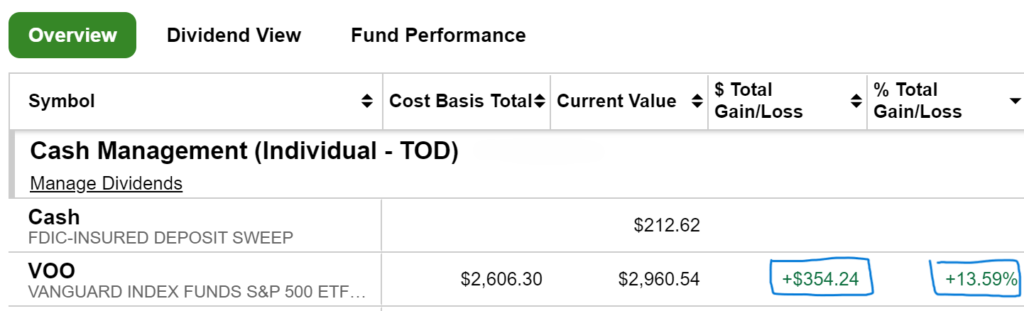

Well, folks, grab your party hats because today marks the 1-year anniversary of this adventure. Drumroll, please… The current value of my VOO investment is $2,960.54, with a cost basis of $2,606.30. That’s a 13.59% return on my investment! Not too shabby, right?

Now, here’s where it gets interesting. I wondered, what if I had invested a lump sum of $2,600 into VOO back in May 2023? The answer might surprise you. According to historical data, that $2,600 would be worth $3,251 today, which equates to a whopping 25.04% return. That’s a jaw-dropping return, one that I haven’t seen matched by any other asset class or investment vehicle.

Of course, timing the market is like trying to predict the weather a year in advance—virtually impossible. But whether you invest a lump sum or spread it out over time, the key takeaway is that the rewards are substantial. Much bigger than not investing at all.

Let’s put it into perspective: $50 a week is about the cost of two meals at a restaurant. In my humble opinion, it’s definitely worth packing a couple of sandwiches and investing that money into an ETF like VOO. After all, wouldn’t you rather feast on financial gains than greasy fries?

So, here’s to another year of investing! May our returns be ever in our favor, and our sandwiches be ever delicious.