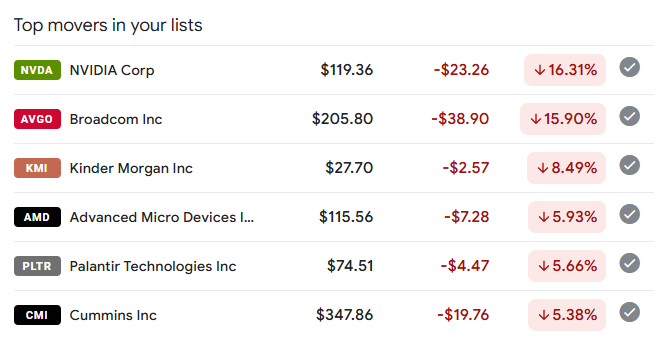

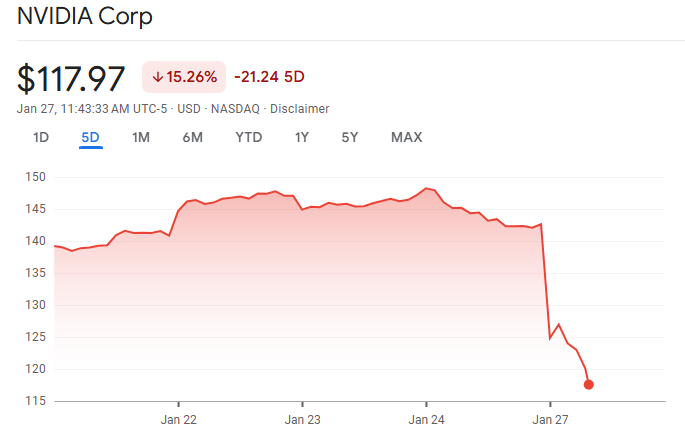

January 27, 2025 – Over the weekend, a major development shook the AI industry. Chinese AI startup DeepSeek unveiled an AI model that rivals OpenAI’s ChatGPT and Meta‘s Llama 3.1—at a fraction of the cost and with significantly lower processing power requirements. Naturally, on Monday, January 27, 2025, NVIDIA (NVDA) stock plummeted by over 15%, dropping from $142.62 at the close on January 24 to approximately $119 at the time of writing. Several other AI-related stocks also experienced sharp declines as the market reacted with skepticism, questioning whether these companies were overvalued.

This raises an important question: Should we buy or sell?

On one hand, skeptics argue that it’s time to sell, believing that these AI companies have overextended themselves with massive capital expenditures. If AI models can now achieve similar performance without relying on NVIDIA’s latest and greatest chips, the demand for cutting-edge hardware could stagnate, potentially stalling growth for chipmakers.

However, I see things differently. I believe this is a buying opportunity and a catalyst for something even bigger. Let me explain with a car industry analogy.

The Car Industry Parallel

What DeepSeek has achieved is akin to someone inventing a more fuel-efficient engine—one that delivers better mileage per gallon. It uses fewer resources to achieve more. When such breakthroughs happen, the impact isn’t limited to the initial disruption; it triggers a broader transformation. Consider these key questions:

- Will competitors simply accept defeat?

Absolutely not. Just as automakers work tirelessly to match or exceed advancements in fuel efficiency, AI leaders like OpenAI and Meta will undoubtedly reverse-engineer DeepSeek’s innovations. They’ll integrate these learnings into their platforms to enhance efficiency and maintain competitiveness. - When fuel costs drop, do people drive less or more?

Historically, lower operating costs lead to increased usage. When vehicles become cheaper to run, people tend to drive more, not less. Similarly, with AI processing becoming more efficient, the demand for AI applications will likely expand, driving further adoption and creating new market opportunities.

This breakthrough isn’t a sign of stagnation; rather, it’s a wake-up call for American AI companies to push the boundaries of efficiency and performance.

The Bigger Picture

For investors, this moment represents a rare opportunity to buy stocks at lower prices before the next wave of innovation takes hold. We live in a capitalist society that thrives on competition and adaptation. Companies will not sit idly by—they will pivot, evolve, and come back stronger.

Today’s drop in stock prices is not the end, but a stepping stone to something bigger and better. The future of AI stocks remains bright.

That’s my two cents.

Related Articles:

- ARLP: A Standout Stock with Growth and High Dividend Income

- Fear or Opportunity? Navigating Volatility in Stock Market

Financial Disclaimer

The information provided on HelpyYourFinances.com is for general informational purposes only and is not intended to be financial advice. While we strive to ensure the accuracy and reliability of the content, it is important to remember that financial decisions are personal and should be tailored to your individual circumstances.

We strongly recommend that you consult with a qualified financial advisor or other professional before making any financial decisions. The content on this website should not be considered a substitute for professional financial advice, analysis, or recommendations. Any reliance you place on the information provided is strictly at your own risk.