When you borrow money or invest, you’ll often see terms like APR (Annual Percentage Rate) and APY (Annual Percentage Yield). While they sound similar, they mean very different things and can have a big impact on your finances. Let’s break them down in a way that’s easy to understand.

What is APR (Annual Percentage Rate)?

APR is the cost of borrowing money. It represents the yearly interest rate on a loan or credit card, but it does not include the effect of compounding. Lenders use APR to show you how much you’ll pay in interest over a year.

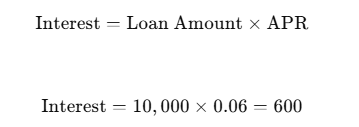

Example:

Let’s say you take out a $10,000 personal loan with a 6% APR for one year. Your interest cost would be:

So, you’d pay $600 in interest over the year. Since APR does not account for compounding, it’s a simple calculation.

Where You See APR:

- Credit cards

- Mortgages

- Auto loans

- Personal loans

What is APY (Annual Percentage Yield)?

APY is the real return on your savings or investment. It accounts for compounding interest, which means you earn interest on both your original money and the interest that builds up over time.

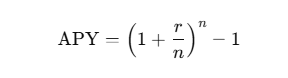

The APY Formula:

Where:

- r = annual interest rate (as a decimal)

- n = number of times interest is compounded per year

Example:

If you deposit $10,000 in a savings account with a 6% APY (compounded monthly), your balance grows beyond just $600 in interest because of compounding.

How Compounding Affects Your Money

The frequency of compounding makes a difference. Let’s compare two scenarios:

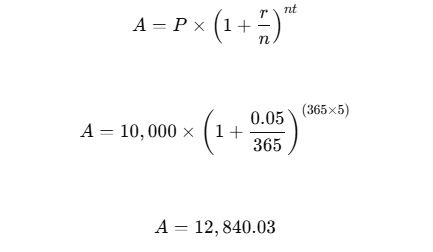

Scenario 1: Compounded Daily (365 times per year)

Final Amount After 5 Years: $12,840.03

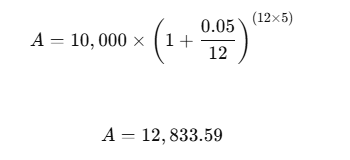

Scenario 2: Compounded Monthly (12 times per year)

Final Amount After 5 Years: $12,833.59

Even though both accounts have the same interest rate, the one with daily compounding earns a little more over time.

Key Differences Between APR and APY

| Feature | APR (Annual Percentage Rate) | APY (Annual Percentage Yield) |

|---|---|---|

| Purpose | Borrowing money | Earning interest |

| Includes Compounding? | ❌ No | ✅ Yes |

| Used For | Loans, credit cards, mortgages | Savings, investments, CDs |

| Impact on Money | Higher APR = More expensive debt | Higher APY = More earned interest |

Quick Rule of Thumb:

- Lenders use APR because it looks lower. (No compounding = seems cheaper.)

- Banks advertise APY because it looks higher. (Compounding = earns you more.)

Why It Matters to You

- If you’re borrowing, focus on APR. A lower APR means you’ll pay less interest on loans or credit cards.

- If you’re saving or investing, focus on APY. A higher APY helps your money grow faster.

- Compounding frequency matters! Daily compounding earns you more than monthly or yearly compounding.

Example in Action: Imagine two savings accounts:

- Bank A: 5.85% interest, compounded daily → 6.00% APY

- Bank B: 5.85% interest, compounded annually → 5.85% APY

Even though the rates seem the same, Bank A earns more because of daily compounding.

Final Takeaway

- Borrowing? Look at APR. Lower is better.

- Saving or investing? Look at APY. Higher is better.

- Always compare apples to apples—don’t be fooled by marketing tricks!

Understanding the difference between APR and APY can save you money on loans and help you grow wealth faster. Now that you know how it works, you can make smarter financial decisions!

Related Articles:

- What Falling Interest Rates Mean for Your Family

- Why Paying Off a 2.69% Car Loan Beats Earning 4% Interest

Financial Disclaimer

The information provided on HelpyYourFinances.com is for general informational purposes only and is not intended to be financial advice. While we strive to ensure the accuracy and reliability of the content, it is important to remember that financial decisions are personal and should be tailored to your individual circumstances.

We strongly recommend that you consult with a qualified financial advisor or other professional before making any financial decisions. The content on this website should not be considered a substitute for professional financial advice, analysis, or recommendations. Any reliance you place on the information provided is strictly at your own risk.