Every day, I look for stocks that have taken a hit and appear on the list of stock losers. When scanning through these stocks, I follow a set of criteria to identify potential investment opportunities:

- Familiarity with the company – I prefer companies whose products and services I use or am familiar with.

- Significant drop in value – The stock should be down by around 10% for the day.

- Market capitalization – The company must have a market cap of at least $1 billion.

- Company longevity – The company should have been in business for more than 10 years.

- Reason for decline – The drop should not be due to fraud or accounting issues.

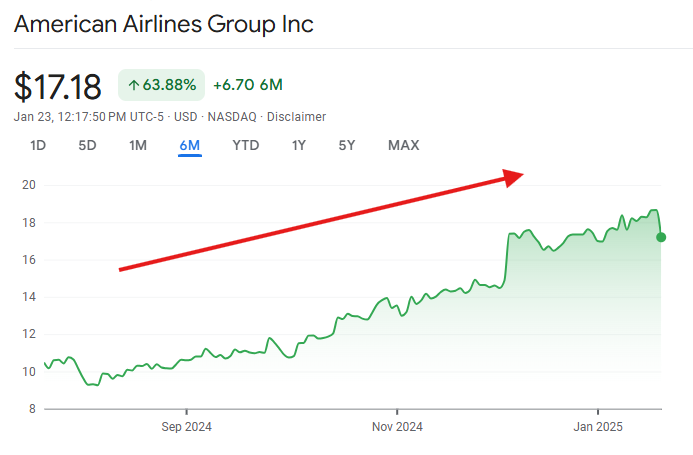

Today’s Pick: American Airlines (AAL)

Today, I found a stock that met all my criteria: American Airlines (AAL).

- Familiarity: I’ve personally flown with American Airlines and have experience with their services.

- Stock Drop: At the beginning of the day, the stock was down by 9%.

- Market Cap: AAL has a market capitalization of $11.26 billion.

- Longevity: American Airlines has been in business for over 12 years.

- Reason for Decline: The stock dropped due to a weak outlook for 2025, not because of mismanagement or financial irregularities.

The Logic Behind This Approach

To make money in the stock market, the fundamental principle is to buy at a discount. Discounts, however, come with risk, and the key is managing that risk effectively.

How I Manage Risk

- Company Knowledge: As a consumer, my familiarity with American Airlines gives me confidence in their ability to deliver services. If their services were consistently poor, I wouldn’t consider investing. Since they offer good products, I believe they have potential for long-term success.

- Market Capitalization: A market cap of $11.26 billion indicates widespread ownership and investor confidence. While some will sell during downturns, many long-term investors will hold or buy more shares.

- Company Maturity: Having been in business for over a decade, American Airlines has weathered various economic cycles and challenges. Their experience suggests they can navigate current headwinds.

- Reason for Drop: Since the decline is due to external market conditions rather than internal issues, I believe the company can recover over time.

The primary risk here is the weak outlook for 2025. While this factor can influence short-term performance, many elements are beyond the company’s control. However, in a capitalist economy, businesses adapt and overcome challenges. I trust that American Airlines’ management will find ways to adjust to new costs and weak demand to drive profitability in the long run.

Historical Analysis

Looking at AAL’s stock charts provides additional insights:

- 6-Month Chart: The stock is on an upward trajectory, indicating positive momentum.

- 5-Year Chart: AAL has experienced multiple peaks and valleys. Historically, each valley has been followed by a climb, showcasing resilience.

My Goal

If AAL stock recovers quickly, I would be satisfied with a 10% gain. This would validate my strategy of buying the dip and capitalizing on market fluctuations.

Conclusion

The key takeaway from my investing strategy is:

- Identify discounted stocks by reviewing the list of losers daily.

- Assess them based on familiarity, market cap, longevity, and reasons for the drop.

- Buy early in the day when the market opens, as this is typically when dips occur.

By following this approach consistently, I aim to turn short-term market fluctuations into profitable opportunities.

Related Articles:

- Fear or Opportunity? Navigating Volatility in Stock Market

- Stock Market Basics, What Does It Mean to Own a Stock?

Financial Disclaimer

The information provided on HelpyYourFinances.com is for general informational purposes only and is not intended to be financial advice. While we strive to ensure the accuracy and reliability of the content, it is important to remember that financial decisions are personal and should be tailored to your individual circumstances.

We strongly recommend that you consult with a qualified financial advisor or other professional before making any financial decisions. The content on this website should not be considered a substitute for professional financial advice, analysis, or recommendations. Any reliance you place on the information provided is strictly at your own risk.