The U.S. Dollar (USD) has been the cornerstone of the global financial system for decades. However, an emerging alliance known as BRICS — comprising Brazil, Russia, India, China, and South Africa — is making waves in the economic world. One of BRICS’ stated goals is to reduce dependence on the U.S. Dollar in global trade and finance. But why are they doing this, and what does it mean for you, the average U.S. citizen?

Why BRICS Wants to Challenge the U.S. Dollar

The dominance of the U.S. Dollar gives the United States several strategic advantages:

- Global Reserve Currency: Most countries hold USD as a reserve currency, giving the U.S. an economic edge in borrowing and trade.

- Sanctions Tool: The U.S. can leverage the dollar-based financial system to impose sanctions, as seen with Russia.

- Trade Dominance: Global commodities, such as oil, are priced in dollars, creating constant demand for the currency.

BRICS nations view this dominance as a way for the U.S. to exert control over the global economy. To counter this, they are working on several initiatives:

- Trade in Local Currencies: Members are negotiating trade agreements that bypass the dollar by using their own currencies.

- A New BRICS Currency: Speculation exists about a BRICS reserve currency designed to challenge the dollar directly.

- Payment System Alternatives: Systems like China’s Cross-Border Interbank Payment System (CIPS) aim to reduce reliance on SWIFT, the global financial messaging network tied to USD transactions.

What Would a Weaker Dollar Look Like?

If BRICS succeeds in reducing global reliance on the U.S. Dollar, the impact could ripple across the American economy. Here are some potential outcomes:

1. Higher Inflation

- The U.S. currently benefits from the dollar’s global reserve status, which keeps borrowing costs low. If demand for USD decreases, borrowing costs could rise, and inflation may increase.

- Everyday goods, particularly imported items like electronics, clothing, and oil, could become more expensive as the dollar loses purchasing power internationally.

2. Rising Interest Rates

- To counteract inflation and stabilize the dollar, the Federal Reserve might raise interest rates further. This could make mortgages, car loans, and credit card debt more expensive for Americans.

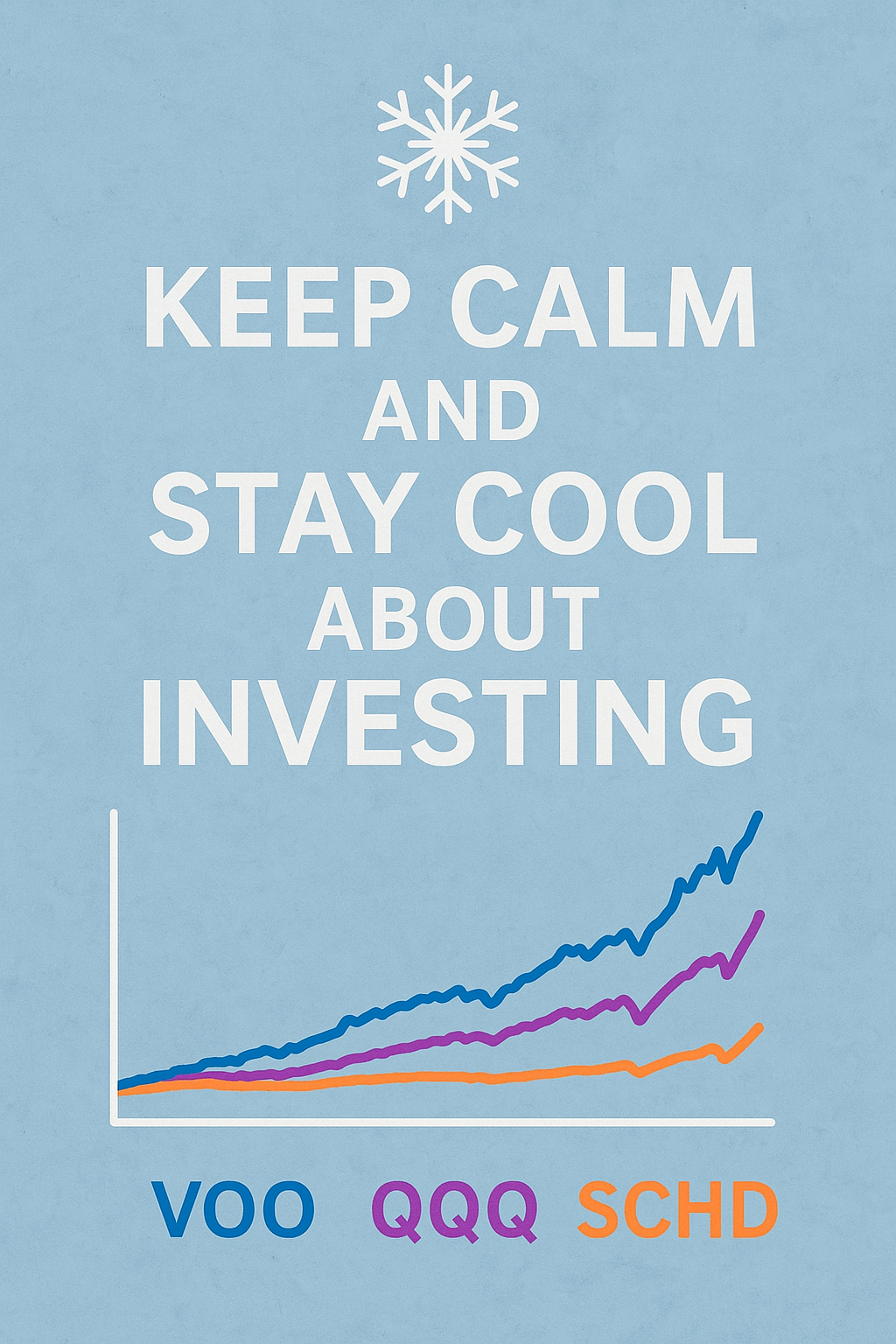

3. Impact on Investments

- A weaker dollar could mean lower returns on U.S. bonds and stocks, as foreign investors may seek alternatives.

- For retirement savers and investors, portfolios heavily reliant on domestic assets could face added volatility.

4. Changing Global Power Dynamics

- The dollar’s dominance has supported U.S. influence globally. If BRICS succeeds, the U.S. might find it harder to project economic and political power abroad, potentially leading to a less stable global order.

How This Could Affect Everyday Americans

For most Americans, a weakened dollar might translate to noticeable changes in daily life:

- Cost of Living: Prices for goods that rely on imports, such as fuel, food, and electronics, could increase.

- Travel Costs: International travel may become more expensive as the dollar’s value declines against other currencies.

- Job Market: U.S. businesses that rely on exports could benefit from a weaker dollar, but those dependent on imports might face higher costs, potentially impacting wages and employment.

Is the U.S. Dollar’s Dominance Truly at Risk?

While BRICS is making progress, the U.S. Dollar’s position remains strong for now. Key reasons include:

- Trust and Stability: The U.S. has a well-established financial system and rule of law, which other currencies struggle to match.

- Network Effect: The global economy is deeply tied to the dollar, and transitioning away would be complex and costly.

- Reserve Currency Competition: While BRICS aims to reduce reliance on the dollar, no single BRICS currency currently has the liquidity or trust to replace it.

What Can You Do to Prepare?

While the impact of BRICS on the dollar may take years to materialize, it’s wise to take proactive steps:

- Diversify Investments:

- Consider holding assets in foreign markets or commodities like gold that can hedge against dollar weakness.

- Reduce Debt:

- Rising interest rates could make debt more expensive. Paying down high-interest loans now can save money in the long run.

- Stay Informed:

- Keep track of economic news, especially developments related to BRICS and global trade shifts.

- Build Emergency Savings:

- A stronger financial safety net can help you weather potential economic volatility.

Conclusion

BRICS’ efforts to weaken the U.S. Dollar’s dominance signal a shift in global economic power. While these changes may not happen overnight, the potential impact on the U.S. economy and your daily life is significant. Staying informed and financially prepared is key to navigating a future where the dollar might not hold the same sway it does today.

Related Articles:

- Why America Must Tackle Its Rising National Debt

- Fear or Opportunity? Navigating Volatility in Stock Market

Financial Disclaimer

The information provided on HelpyYourFinances.com is for general informational purposes only and is not intended to be financial advice. While we strive to ensure the accuracy and reliability of the content, it is important to remember that financial decisions are personal and should be tailored to your individual circumstances.

We strongly recommend that you consult with a qualified financial advisor or other professional before making any financial decisions. The content on this website should not be considered a substitute for professional financial advice, analysis, or recommendations. Any reliance you place on the information provided is strictly at your own risk.