In today’s news cycle, inflation has become the economic boogeyman. Headlines scream about rising prices, shrinking purchasing power, and the Federal Reserve’s efforts to tame inflation with interest rate hikes. This constant stream of economic anxiety has left many Americans feeling helpless—worried about how far their dollar will stretch tomorrow. Yet, amid all this noise, there’s almost no mention of the opposite phenomenon: deflation.

Deflation, while quieter in the headlines, carries its own set of dangers. What’s missing in the public conversation is a balanced view: that a small, controlled amount of inflation is actually a good thing for a healthy economy. Let’s break down both concepts and dive into what history has taught us.

What Is Inflation?

Inflation is the rate at which the general level of prices for goods and services rises over time, resulting in a decrease in purchasing power. For example, if the inflation rate is 3%, something that cost $100 last year would cost $103 this year.

Causes of Inflation:

- Increased demand for products and services

- Rising production costs

- Supply chain disruptions

- Monetary policy (printing more money)

What Is Deflation?

Deflation is the opposite: a decrease in the general price level of goods and services. This means your money can buy more than it could before.

Causes of Deflation:

- A drop in consumer and business spending

- Surplus of goods

- Technological advancements increasing productivity

- Tight monetary policy (less money in circulation)

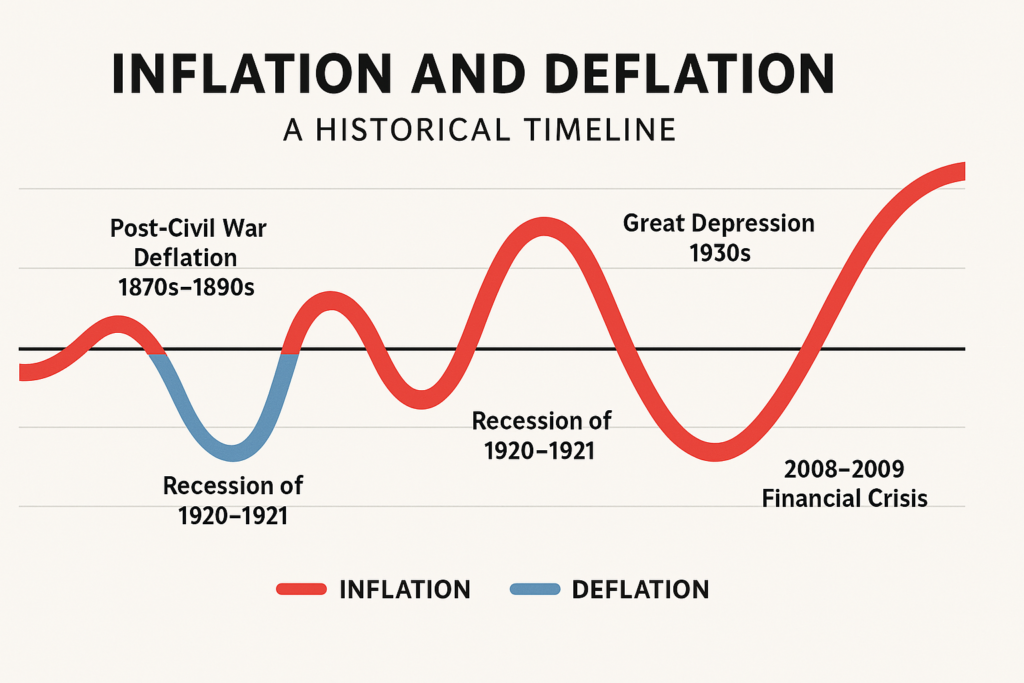

Historical Timeline: 100 Years of Inflation and Deflation

To understand the impact of inflation and deflation, let’s look at notable periods in U.S. history:

1. The Great Depression (1930s)

- Deflation: Prices fell sharply

- Resulted in massive unemployment and economic contraction

Post-WWII Boom (1945–1970s)

- Moderate inflation: Healthy economic growth and consumer spending

Stagflation Era (1970s–Early 1980s)

- High inflation: Oil shocks, high interest rates

- Inflation reached double digits

1990s–2000s

- Mild inflation: Economic expansion, stable prices

2008 Financial Crisis

- Mild deflation scare: Fed intervened with stimulus to avoid spiral

COVID-19 Pandemic (2020–2021)

- Short deflation, then rising inflation due to supply chain breakdowns and stimulus spending

Post-COVID (2022–2024)

- High inflation: Housing, fuel, and food prices surged

See infographic below for a visual timeline of these economic shifts.

Why a Little Inflation Is a Good Thing

While too much inflation can be harmful, a small, steady rate of inflation (around 2%) is actually beneficial:

1. Encourages Spending and Investment

When people expect prices to rise slightly over time, they’re more likely to spend or invest their money now instead of hoarding it.

2. Helps Businesses Grow

Slightly rising prices give companies room to increase wages, invest in innovation, and expand operations.

3. Eases Debt Burden

With inflation, the real value of money decreases over time. That makes it easier for borrowers to repay loans with “cheaper” dollars.

4. Supports Wage Growth

As businesses raise prices, they typically raise wages too—keeping income growth aligned with the cost of living.

Conclusion

While inflation may dominate the headlines and strike fear into the hearts of consumers, it’s important to remember that not all inflation is bad. In fact, a modest amount is essential for a thriving economy. Deflation, though rarely discussed, can be far more damaging when it spirals out of control. The goal isn’t to eliminate inflation—but to manage it.

Understanding the dance between inflation and deflation helps us see beyond the fear and toward a more balanced financial future.

Related Articles:

- Understanding the 2% Inflation Rate and Its Importance

- Why a Big Tax Refund Might Be Costing You Money

Financial Disclaimer

The information provided on HelpyYourFinances.com is for general informational purposes only and is not intended to be financial advice. While we strive to ensure the accuracy and reliability of the content, it is important to remember that financial decisions are personal and should be tailored to your individual circumstances.

We strongly recommend that you consult with a qualified financial advisor or other professional before making any financial decisions. The content on this website should not be considered a substitute for professional financial advice, analysis, or recommendations. Any reliance you place on the information provided is strictly at your own risk.