In a world where headlines scream panic and stock tickers flash red, it’s easy to feel like you need to hit the eject button on your investments. But here’s the truth seasoned investors already know:

Market dips aren’t disasters—they’re discounts.

If you’re investing in solid ETFs like VOO, QQQ, and SCHD, staying the course could be the best financial decision you make this year. In this article, we’ll break down why these three ETFs are powerful, long-term investment vehicles—and why now might be the best time to double down.

🕺 Keep Calm, Stay Cool, and Keep Buying

Let’s start with the mindset: Investing isn’t about reacting to every bump in the market. It’s about consistency, patience, and long-term growth.

We’re currently in an era where top-tier ETFs are becoming cheaper. Rather than panicking, savvy investors see this as an opportunity to grab more shares at a discount.

Think of it this way: If your favorite pair of shoes were 20% off, you’d stock up, right? The same logic applies here. VOO, QQQ, and SCHD are fundamentally strong ETFs—buying them at lower prices simply increases your future gains when the market recovers.

“Be fearful when others are greedy and greedy when others are fearful.” – Warren Buffett

🌎 The Power of VOO, QQQ, and SCHD

Let’s break down the appeal of these three ETFs:

1. VOO – Vanguard S&P 500 ETF

- What it is: VOO tracks the S&P 500, giving you exposure to 500 of the biggest U.S. companies.

- Why it rocks: It offers broad market exposure, ultra-low expense ratio (0.03%), and long-term performance.

- Who it’s for: The long-haul investor who wants diversification and stability.

2. QQQ – Invesco QQQ Trust

- What it is: QQQ follows the Nasdaq-100, giving you access to the biggest names in tech and growth.

- Why it rockets: Tech may dip in rough times, but when recovery hits, it soars. QQQ is like strapping a jetpack to your portfolio.

- Who it’s for: Investors looking for growth potential and exposure to innovation.

3. SCHD – Schwab U.S. Dividend Equity ETF

- What it is: SCHD invests in high-quality U.S. companies with strong dividend payouts.

- Why it’s chill: With a higher dividend yield (~4.16%) and strong fundamentals, SCHD gives your portfolio a nice income boost while still growing steadily.

- Who it’s for: Income-focused investors who also want long-term appreciation.

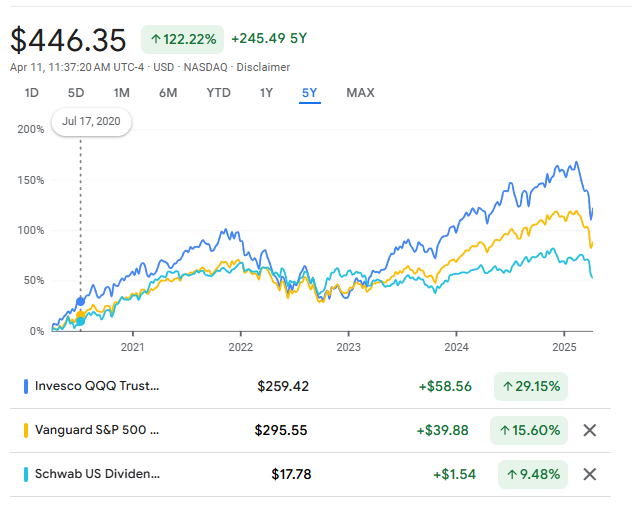

📈 Performance Snapshot (2011-2025)

Here’s how these ETFs have performed over time:

| ETF | Total Return | Annualized Return | Expense Ratio | Dividend Yield (TTM) |

|---|---|---|---|---|

| VOO | +278.79% | +10.40% | 0.03% | ~1.40% |

| QQQ | +499.28% | +14.22% | 0.20% | ~0.67% |

| SCHD | +223.10% | +9.10% | 0.06% | ~4.16% |

Source: Total Real Returns

These returns include reinvested dividends and adjust for inflation—a true picture of long-term growth and value.

⚡ Final Thoughts: Stay the Course

It’s tempting to react emotionally when the market gets choppy. But this is the moment when real wealth is built—when you buy quality assets at a discount and let time do the heavy lifting.

By consistently investing in VOO, QQQ, and SCHD, you’re:

- Diversifying across market sectors

- Balancing growth and income

- Building a future-proof portfolio

So next time the market takes a dip, don’t panic.

Just take a deep breath, stay cool, and buy the dip.

Because fortune favors the steady, not the shaky.

Ready to level up your investing game? Follow along at HelpYourFinances.com for more actionable tips and mindset shifts that build wealth over time.

Related Articles:

Financial Disclaimer

The information provided on HelpyYourFinances.com is for general informational purposes only and is not intended to be financial advice. While we strive to ensure the accuracy and reliability of the content, it is important to remember that financial decisions are personal and should be tailored to your individual circumstances.

We strongly recommend that you consult with a qualified financial advisor or other professional before making any financial decisions. The content on this website should not be considered a substitute for professional financial advice, analysis, or recommendations. Any reliance you place on the information provided is strictly at your own risk.